Exact Differences Between Bitcoin and Bitcoin Cash

Bitcoin emerged in 2009 as the successor to several earlier cryptocurrencies, including HashCash, Bit Gold, and B-money, which failed to achieve the decentralization that Bitcoin embodies. Bitcoin ushered in a new era in internet financing, prioritizing decentralization and anonymity.

However, in its nascent stages, Bitcoin was not the household name it is today. Over time, as its potential became apparent, an increasing number of individuals began participating in the Bitcoin network.

As the Bitcoin community expanded, scalability issues arose due to limitations in the Bitcoin blockchain. For instance, the block size was restricted to 1MB, allowing for only 7 transactions per second. Consequently, users faced higher fees to expedite transaction confirmations.

To address this challenge, the Bitcoin community implemented a Soft Fork known as SegWit. SegWit facilitated faster transaction processing by segregating signature data from the block.

Here is a post that helps you understand What is Hard and Soft Forks.

While SegWit marked a significant improvement, some members of the Bitcoin community argued that it was insufficient to enhance transaction speed. They proposed increasing the block size. However, many members opposed this proposal, citing concerns that larger blocks would strain smaller nodes and compromise decentralization.

This contentious debate resulted in the formation of two factions within the Bitcoin community. Those advocating for increased block size opted for a Hard Fork, resulting in the creation of a new coin known as Bitcoin Cash (BCH), which aimed to address the scalability issue through larger block sizes.

What is Bitcoin Cash (BCH)?

As I previously mentioned, BCH is a cryptocurrency that originated from the Bitcoin blockchain following a Hard Fork.

The hard fork took place on August 1, 2017, after the 478,558th Bitcoin block. This event led to the creation of Bitcoin Cash (BCH), boasting 8MB block capacity aimed at expediting the verification process. It also features an adjustable level of difficulty to ensure the chain’s resilience and transaction verification speed.

Despite parting ways with Bitcoin, Bitcoin Cash shares similarities with its predecessor. Both cryptocurrencies have a total supply of 21 million coins and utilize the Proof of Work (POW) consensus mechanism to mint new coins.

While Bitcoin Cash’s increased block size appears to enhance transaction speed, a closer examination of the differences between the two reveals more insights.

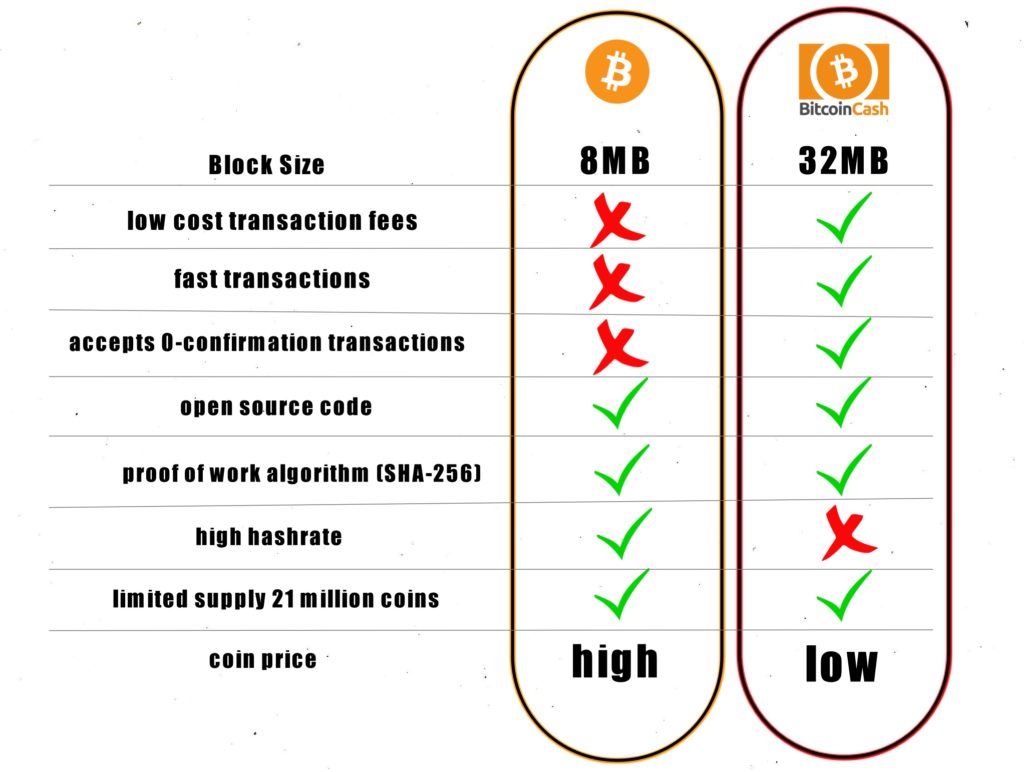

Exact Differences Between Bitcoin (BTC) and Bitcoin Cash (BCH).

Block Size.

Bitcoin’s block size is limited to 1MB, but the implementation of SegWit has expanded block capacity by segregating signature data.

Bitcoin Cash, on the other hand, has an 8MB block limit. In May 2018, Bitcoin Cash underwent a hard fork, further increasing the block size to 32MB. However, Bitcoin Cash has not integrated SegWit into its blockchain.

Transaction Speed.

With its 32MB block capacity, Bitcoin Cash can process up to 25,000 transactions per block.

Bitcoin typically handles between 1,000 and 1,500 transactions per block. Additionally, the Lightning Network implementation has significantly accelerated transaction processing in Bitcoin.

Transaction Fee.

Bitcoin experienced a surge in transaction fees in December 2017, peaking at $55.16.

Currently, the average Bitcoin transaction fee is $0.592. In contrast, Bitcoin Cash maintains an average transaction fee of $0.0032 since its inception, never exceeding $1.

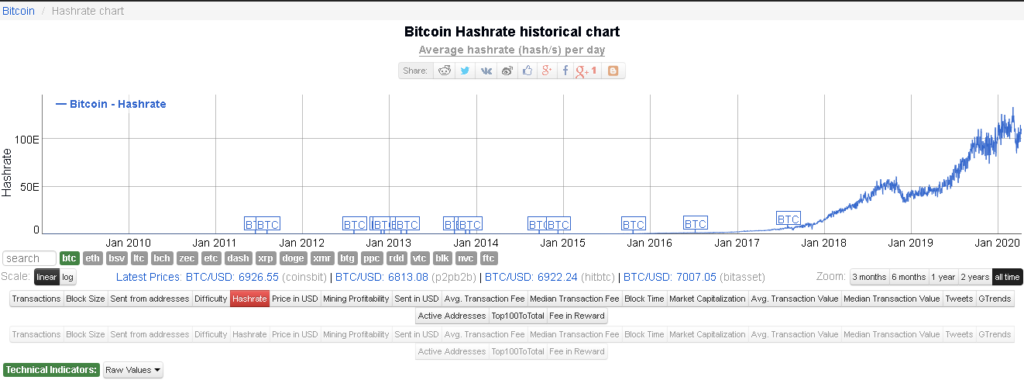

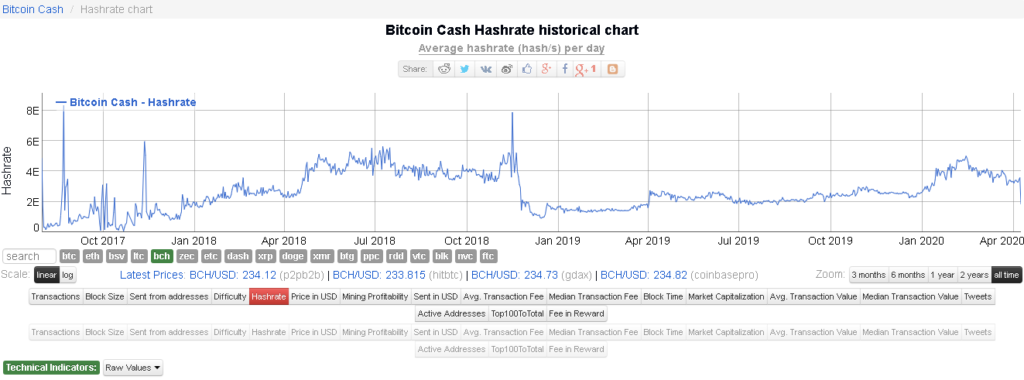

Hash Rate.

Hash Rate, representing the mining power, denotes the speed at which a cryptocurrency mining device operates to confirm transactions.

Bitcoin boasts a hash rate of 104 exahash, while Bitcoin Cash stands at 3 exahash.

This makes Bitcoin approximately 50 times more powerful than Bitcoin Cash.

Fork.

Bitcoin stands as the progenitor of over 105 coins that forked from its original blockchain, including Bitcoin Cash.

As of now, only 74 of these forks remain active, while 31 are considered defunct.

Bitcoin Cash experienced its sole fork on November 15, 2018, giving rise to a currency known as Bitcoin Cash SV (Satoshi Version).

Adoption.

Compared to Bitcoin Cash, Bitcoin is a seasoned and widely recognized cryptocurrency, enjoying priority treatment from wallets, exchanges, and merchants.

Data reveals that Bitcoin processes over 200,000 transactions daily, whereas Bitcoin Cash typically handles between 50,000 and 90,000 transactions.

While occasional transaction spikes exceed 2 million, Bitcoin Cash remains powerful yet less renowned than Bitcoin.

Price.

As the reigning monarch of the crypto realm, Bitcoin boasts a market cap exceeding $100 billion, dominating over 60% of the entire crypto market.

Presently, Bitcoin is priced at $65,200 while Bitcoin Cash commands a price of $412 with a market cap of $4 billion.

Security.

Every cryptocurrency operating on the Proof of Work (POW) consensus mechanism harbors concerns about the dreaded 51% attack.

In Bitcoin, the distributed hash rates, attributed in part to its 1MB block threshold, empower smaller nodes to contribute to network integrity and decentralization.

Conversely, Bitcoin Cash’s 32MB block size diminishes opportunities for small node participation, potentially exposing the network to vulnerabilities like the 51% attack.

These represent the key disparities between Bitcoin and Bitcoin Cash.

You can check out the below image that shows differences in simplest form.

Conclusion.

While discerning the disparities between Bitcoin and Bitcoin Cash is straightforward, choosing between them depends on your specific crypto needs and preferences.

The ongoing debate surrounding Bitcoin and Bitcoin Cash’s merits is well-known, with notable figures like Roger Ver and Tone Vays engaged in fervent discussions.

Roger Ver, a prominent figure in the crypto sphere, has championed Bitcoin Cash due to disagreements with the Bitcoin community, particularly regarding scalability.

Conversely, Tone Vays, leveraging a finance background from Wall Street, advocates for Bitcoin as a symbol of economic freedom.

If this post seems to be an informative one, don’t forget to share it with your family and friends.