What is a Hard Fork and Soft Fork?.

If you’re passionate about crypto, then you’ve likely come across the term “Fork” in the crypto space.

Traditionally, a fork means a split into two. However, in the world of cryptocurrency, the concept of a fork holds a broader significance than the conventional understanding.

As enthusiasts, we’re familiar with the backbone of cryptocurrencies: the Blockchain. Think of it as a vast ledger book that meticulously records transaction details on each page.

Just like in a ledger book, when one page is filled with transaction records, a new page is added, and this process perpetuates, expanding the ledger book’s size.

Similarly, in Blockchain, when a block reaches its capacity to store transaction details, a new block is appended to the Blockchain, with the assistance of individuals who diligently track the Blockchain’s progress.

These individuals form the community associated with that particular currency. However, to participate in a currency’s Blockchain, this community must adhere to certain rules.

These rules encompass various aspects, such as block size and incentives for participants (Miners) responsible for adding new blocks to the Blockchain.

Should the community deem it necessary, they possess the right to amend or upgrade these rules. Such alterations or enhancements are known as Forks.

Primarily, there are two types of Forks: Hard Forks and Soft Forks.

Let’s delve into what distinguishes Hard and Soft Forks.

Hard Fork.

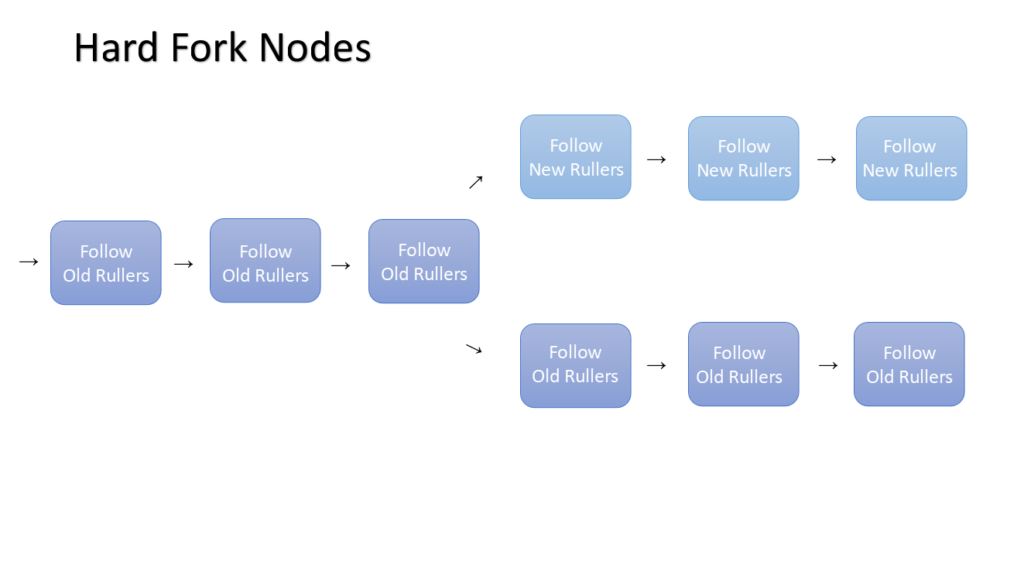

When certain members within a coin community advocate for an upgrade capable of altering the coin protocol in a way that renders it incompatible with previous versions, those who do not update to the new version risk being unable to process transactions or contribute new blocks to the blockchain.

This situation often results in the formation of two distinct communities within the same coin ecosystem—one adhering to the old rules, and the other embracing the new protocol.

For example, in 2017, Bitcoin underwent a hard fork, resulting in a split where the original blockchain remained as Bitcoin (BTC), while the new chain was named Bitcoin Cash (BCH), promising enhanced transaction speed and performance.

In a hard fork scenario, community members have the freedom to continue participating in the old blockchain if they choose, but they have no association with the new blockchain.

Soft Fork.

A soft fork represents another type of fork, but have some distinct nature from a hard fork.

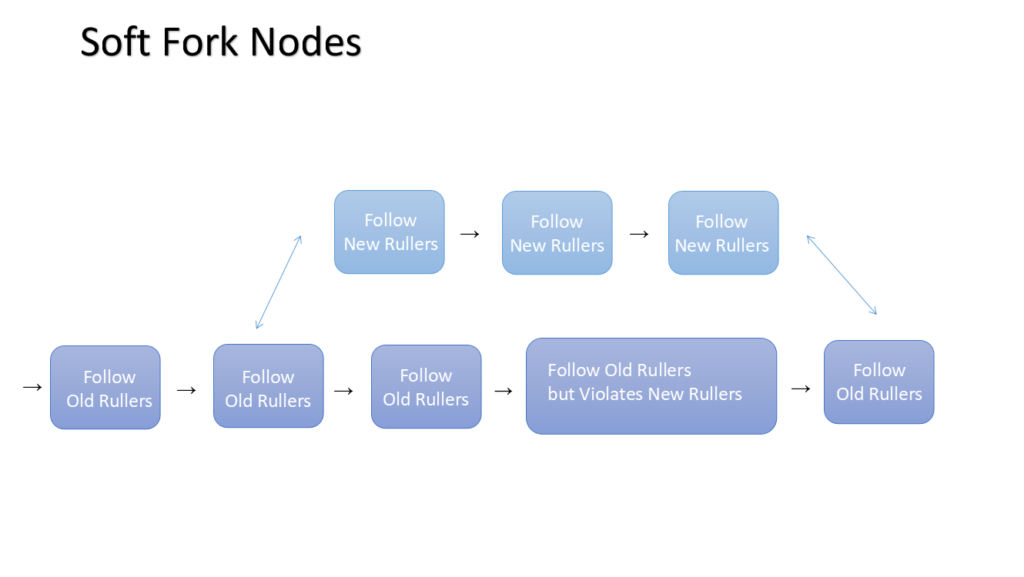

In a soft fork, if certain community members introduce changes to blocks, both the altered and older blocks retain the ability to process transactions and contribute new blocks to the blockchain, provided they adhere to the new protocol rules.

Think of a soft fork as an upgraded version of your favorite software—you can still utilize the older version even if you haven’t downloaded the upgrade. However, those who have updated can access the enhanced features of the software.

For example, if a soft fork introduces a new rule reducing block size from 4MB to 3MB, older participants can still process transactions and contribute blocks of 3MB or less. However, attempting to submit a block larger than 3MB to the network will result in rejection by newer participants, as it violates the updated rules. This encourages older participants to transition to the new protocol for efficiency.

Over time, 3MB blocks persist on the blockchain, while 4MB blocks are disregarded.

A prime example of a soft fork is Bitcoin’s 2017 SegWit soft fork, aimed at increasing the block size limit to enhance transaction speed on the Bitcoin blockchain.

With SegWit activation on July 21, 2017, and subsequent unanimous support from Bitcoin mining pools starting August 23, all miners began rejecting blocks incompatible with SegWit from that date onward.

Now that you have a comprehensive understanding of hard and soft forks, recognize their indispensable roles in the evolution of cryptocurrencies.

Here are the Main Reasons for Forks.

- To fix important security risks found in older versions.

In regular paper currency, we manage to increase the security level by adding new paper layers, color, fonts and many more measures taken to increase security but in cryptocurrencies, it will take soo much time to fix security risks.

In a fork, we can fix those security issues easily by choosing the right fork method for currency.

- To add new functionality.

The fact we have Windows 10 today basically means, that the first Windows required some improvements, in fact, lots of improvements.

Same apply to the blockchain, in blockchain the code is also upgraded from year to year. Since it is an open source development, developers work on it worldwide and propose their improvements to the community. If a feature is good enough, it will be added to the next version by doing fork.

- To reverse transactions.

Remember the fake currency? The government could put the rogue in jail but hardly could refund all the people who took it as real money. But in cryptocurrencies, we can actually minimize this harm.

If the community finds out they have a security breach, they can proclaim all the transactions made from a specified date as not existing. Like, never happened by doing fork.

Conclusion.

Hard fork and Soft forks are very essential for a cryptocurrency to ensure security for its community members.

Also, by doing fork community can have a better version of cryptocurrency than the previous one, however by doing a lot of forks can lead to losing the trust from the community for a cryptocurrency.

That’s why it is important to know the reason behind the fork before following it.

If you have any comments on this post, please mention in the comment section.

If you like this article then, do share with your family and friends.