What Is an Automated Market Maker (AMM)? | Everything You Need to Know

As Crypto stretches the boundary by continuously evolving and bringing more opportunities to explore use cases.

DeFi’s emergence further stretched the possibilities in the crypto world and made cryptos truly decentralized.

Before the DeFi revolution, centralized entities like exchanges and wallet services controlled the cryptocurrencies same as the fiat market where banks control the currency flow.

Now with DeFi, everything in the crypto world is decentralized, from trading to storing crypto assets. To achieve this decentralization, Automated Market Maker (AMM) has made a big contribution.

What Is an Automated Market Maker?

As a name, Automated Market Maker is a Market Maker on the exchange platform.

Don’t be confused. First, let’s understand what Market Maker means.

A Market Maker is a middleman who supplies liquidity to the exchange to facilitate trading activities.

Centralized exchanges follow the order book method to execute trades, meaning if you want to buy 1 BTC at $20,000 on an exchange, then the exchange has to look for the seller selling 1 BTC at $20,000. If the exchange immediately found the matched seller, then there is no big deal, your trade is executed in seconds, but if the exchange is not able to find the exact price-matched seller because of many reasons like low trading activities or volatile market conditions, then slippages tend to occur. In other words, the price of an asset at the point of executing a trade shift considerably before the trade is completed.

To avoid slippage and keep a fluid trading system. Exchanges go to the market maker, which are professional traders or financial institutions, to provide liquidity for trading pairs. With the help of a market maker, exchanges execute the trades instantly and maintain the platform liquidation.

However, the whole scenario changes in the Decentralized Exchanges(DEX) because they don’t rely on the centralized market maker, like traders of financial institutions. Instead, DEX relies on the Automated Market Maker(AMM).

AMM is a computer program or a smart contract facilitation liquidity to the decentralized exchange.

AMM uses the Liquidity Pool, where different pairs of crypto assets are locked by the exchange users. And AMM decides the size and the value of a pool.

In essence, on DEX, you’re trading with a smart contract, whereas in Centralized exchange, you trade with the counterparties.

How Do Automated Market Makers Work?

There are different methods used by the platforms to apply the AMM to the liquidity pool.

The most popular one is “on-chain market makers” by Ethereum founder Vitalik Buterin.

The method used the formula of x*y=k, meaning token X balance * token Y balance always equals K in the X/Y liquidity pool.

Here K remains constant, meaning Market Maker adjusts the price of the X and Y tokens when bought and sold.

For example, in an ETH/BTC pool, if you bought ETH, then AMM will adjust the price of ETH to high because there is less ETH left in the pool resulting in the BTC price going down because there is more BTC in the pool. The pool stays in constant balance, where the total value of ETH in the pool will always equal the total value of BTC in the pool. Only when new liquidity providers join in will the pool expand in size.

This brings the arbitrage opportunity for many trades because if the ETH price is lower on the pool than the actual market price, then the trader can take advantage of the price fluctuation and make trades.

But as I mentioned earlier, there is no particular set of AMM formulas being used; Many platforms developed their own set of AMM to work with.

Here Is the List of Platforms Using Their Own AMM.

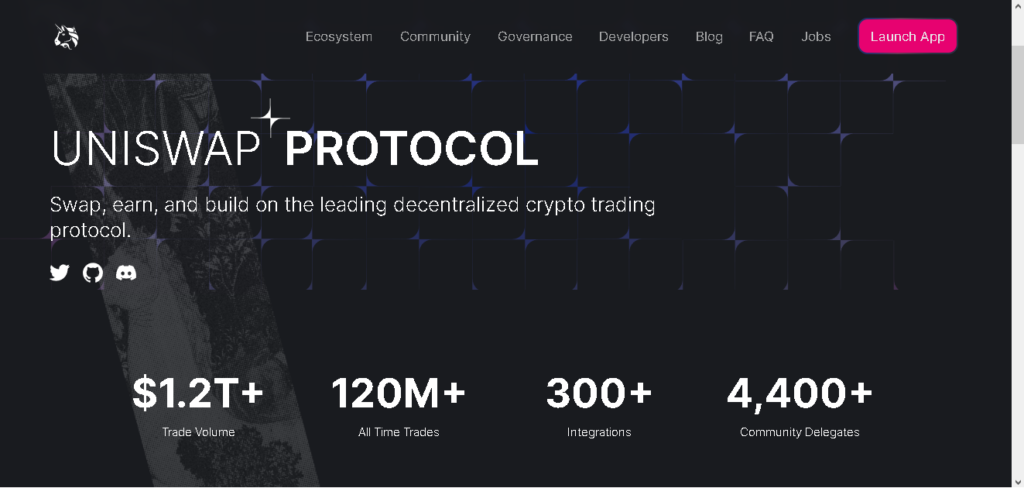

Uniswap.

Uniswap is a famous Decentralized exchange for swapping ERC-20 tokens.

The exchange uses the same x*y=k formula for AMM and allows users to create a liquidity pool with any pair of ERC-20 tokens with a 50/50 ratio.

For every trade, Uniswap charges a 0.30% trading fee with the purpose of controlling the slippage that leads to arbitrage opportunity by imposing the fee every time a trader makes a trade has to pay a fee and to take advantage of slippage they have to make hefty trades paying a hefty fee.

Curve.

Curve is a DEX that uses a different AMM model.

Curve liquidity pools are made up of only similar behaving assets. For example, a stablecoins pool only has stable coins init.

This approach lowers the chance of slippage occurring. And also, Curve doesn’t try to keep the values kept in different assets always equal. This allows Curve to concentrate liquidity near the ideal price for similarly priced assets (in a 1:1 ratio) to have liquidity where it is most needed. Thus, Curve can achieve a much higher liquidity utilization than otherwise possible with those assets.

Balancer.

Balancer uses a constant mean market maker equation [(x y z)³=k] where a pool can consist of more than two tokens.

In Balancer, anyone can create a pool with up to 8 tokens in any ratio.

There are different types of liquidity pools that can be created on the Balancer. And the Balancer finds the best suitable pool for the trader using the algorithm.

Types of pools on Balancer are:

Weighted Pools – 8-token pools with custom weighting.

Two-Token Weighted Oracle Pools – Weighted Pools with two tokens that act as on-chain price oracles.

Stable Pools – Pools with 2-5 tokens that use a StableSwap equation and contain tokens of similar value. For example, DAI/USDC/USDT and WBTC/renBTC/sBTC.

Liquidity Bootstrapping Pool – A 2-4 token pool with the ability to enable and disable trading and change weights. Only the creator can add liquidity.

MetaStable Pools – A generalized Stable Pool that can hold “proportional” assets that are related in price but may slowly drift apart in price. Some example use cases are pools of (DAI/cDAI) and (StablePoolBPT/NewStableCoin).

Investment Pools – An LBP-like pool with the same rights to disable trading and change weights but which allows public LPs. It also supports management fees (as a percentage of swap fees) and higher token counts.

Convergent Curve Pools – A pool designed by Element.fi to support two tokens that converge in price.

Not only do these three exchanges work with AMM there are many Decentralized Exchanges that exist today working with the AMM similar to the above ones, like Sushi Swap and Pancake.

Conclusion.

To make crypto decentralized, AMM plays a crucial part because trading is the activity that controls the entire crypto market. If the Decentralized Exchanges start to pop up using the AMM, then the crypto trading becomes decentralized.

Now the majority of trading activities are done on centralized exchanges that do not have any regulatory authority to control, which leads to scams and many shading activities causing investors money.

To end these centralized entities’ hegemony in crypto trading, decentralized exchanges using AMM can be the solution. But there are also many problems faced by these exchanges now, like impairment loss, rug pulls, and even there is lack of awareness of DEX, so in the future, AMM could become a big thing.