What Are Liquidity Pools? List of Top Liquidity Pools in 2024

In the busy finance world, huge amounts of liquidity are needed to conduct trades.

To supply liquidity, central entities like stock exchanges and crypto exchanges use the order book method, where trade occurs on demand and supply mechanisms.

In the order book method, for a trade to consider successful, demand and supply should match. For example, if you want to buy 10 shares at the rate of $10 for each share, a seller on the platform has to sell the particular share at $10, having the same or exceeding the number of shares you wanted. The same applied to the crypto market.

In this order book method, you rely on the centralized party named a market maker to contact the seller or buyer. To consider your trade successful, your price has to match with the counterparties; otherwise, you have to wait for the market to respond to your price. Also, the market has to have the right seller or buyer for your trade. If they don’t have anyone on the other end, then you can’t conduct any trades.

To eliminate these obstacles of order book method. DeFi (Decentralized Finance) comes with the solution of Liquidity Pools by automating the liquidity game using smart contracts.

What Are Liquidity Pools?

A Liquidity Pool, as the name suggests, is a pool filled with money managed by a smart contract, allowing traders to trade even when there are no counterparty buyers or sellers.

All the liquidity comes from the general public. Anyone can provide liquidity to the pool by depositing crypto assets and then, in return, receives incentives.

The liquidity in the pool is used for swapping, trading, and lending activities.

Within the pool, smart contracts manage all the activities, such as incentivizing and maintaining the liquidity of tokens relative to one another.

The smart contracts may differ from pool to pool.

Here is the list of different liquidity pools you can use in 2024.

List of Liquidity Pools.

1. Uniswap.

Uniswap is a Decentralized Exchange (DEX) supporting all the ERC-20 token contracts, enabling decentralized trading between ETH and any other ERC-20 token.

Uniswap has a pool that provides liquidity to the exchange.

The liquidity pool on Uniswap consists of 2 tokens and supports 1:1 pairings of Ethereum and ERC-20 tokens.

The Automated Market Maker (AMM) algorithm determines the ratio of both tokens deposited to the exchange.

Uniswap’s AMM decides the price of an asset is determined based on the token supply in the respective liquidity pool. For example, in an ETH/LINK pool, there are 20 ETH and 60,000 LINK. Price of ETH = 60,000/20 = 3,000 LINK. Therefore, the value of the total ETH in the pool is $60,000, and the total LINK in the pool is also worth $60,000.

The AMM algorithm ensures and adjusts the prices of assets in such a way that this ratio of the value of assets is always 1:1.

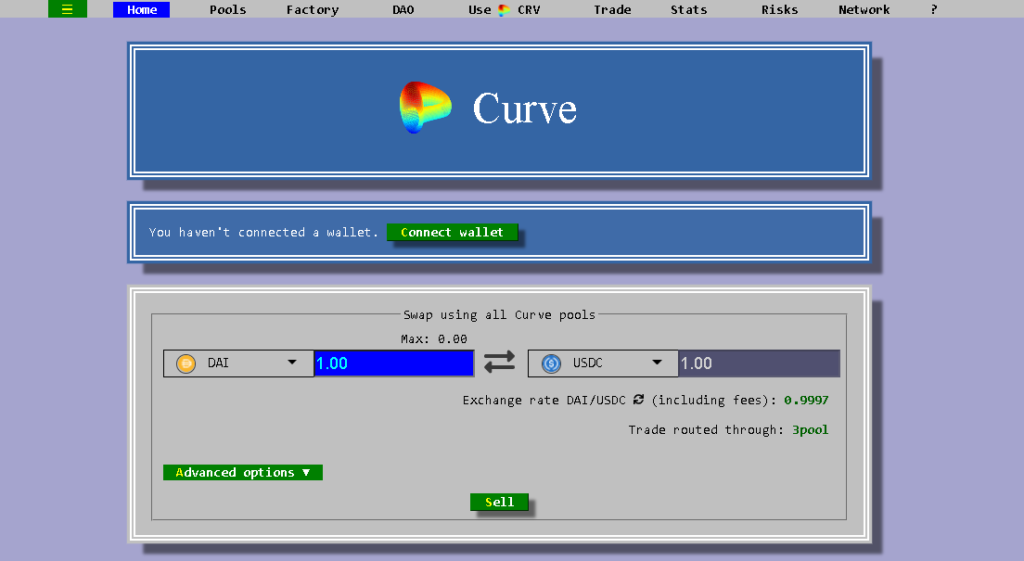

2. Curve Finance.

Curve Finance is also a Decentralized exchange similar to Uniswap, using liquidity pools for operations.

Unlike Uniswap, Curve is limited to stablecoins like DAI, USDT, USDC, GUSD, TUSD, BUSD, UST, EURS, PAX, sUSD, and wrapped versions of assets like wBTC, tBTC.

The Curve AMM algorithm works the same as Uniswap, containing only 2 assets and maintaining the value of assets in the ratio of 1:1.

The big advantage Curve has is that the pool only consists of stablecoins, but in AMM like Uniswap, where liquidity pools can be made up of any token, volatility is high, and impairment loss and slippage also cost you. Whereas assets in the Curve pool are stable to each other in price, trading between them causes minimal volatility compared to other AMM liquidity pools. Also, Curve doesn’t try to keep the values of different assets always equal. Instead, it focuses on balancing liquidity. For example, in a DAI and USDC pool, if more DAI is added to the pool, the pool becomes unbalanced because there is more DAI than USDC, and the pool sells DAI at a slight discount compared to USDC to incentivize balance, the pool rebalances its ratio of DAI to USDC.

Curve also keeps the same formula for wrapped assets, but wrapped assets like wBTC and renBTC can be in the same Curve liquidity pool, whereas wBTC and USDC would not be a functional combination.

3. Bancor.

Bancor is a Decentralized Exchange that relies on Liquidity pools to facilitate all kinds of activities.

Bancor’s liquidity pools use a similar automated market-making algorithm as the platforms mentioned above.

To address concerns of volatility in the liquidity pool Bancor uses its stablecoin BNT as a reserve currency. As a result of the BNT introduction, you can create a pool without a pairing. For example, if you deposit $100,000 in the LINK pool, it triggers $100,000 of BNT token emissions by the protocol into the LINK pool.

Protocol-invested BNT generally remains in the pool earning fees until the associated stake (i.e., your LINK deposit) is withdrawn, at which point the protocol burns the BNT it had invested and its accumulated fees.

In the pool of paired crypto assets, BNT tokens are used as an intermediary currency when each token is traded.

BNT token involvement in the pool is given a chance to BNT holders to stake their BNT into any trading pair pool available on the Bancor network to earn rewards and a portion of trading fees.

4. Balancer.

Balancer is a decentralized exchange and a non-custodial portfolio manager.

Balancer uses AMM modular pooling protocol where a pool acts like an index fund in which you create a liquidity pool based on the cryptocurrencies in your portfolio. These funds are known as Balancer pools, and any user wishing to provide liquidity to a pool can do so by simply depositing an asset in them. For example, If you are a liquidity provider looking to participate in an existing 80/20 ETH/BTC pool on Balancer and have 10 BTC to spend, the steps would be rough as follows:

- You provide 10 BTC to the pool.

- 2 BTC is deposited to the pool.

- 8 BTC is converted to the equivalent value in ETH.

- The protocol looks across all the pools containing ETH and BTC for the best price to execute this exchange.

- 8 BTC worth of ETH is deposited into the pool.

- You receive Balancer pool tokens representing your share of the pool.

- These Balancer tokens will always be redeemable for 80% ETH and 20% BTC.

- Balancer now has more BTC than ETH compared to before you entered the pool.

- To maintain the 80/20 value ratio, the price of BTC decreases relative to ETH.

Moreover, Balancer bifurcates the pool into two different names Native and Smart pools.

Native pools are categorized into two types: Private, Public, or Shared pools.

In Private pools, pool owners can only have complete authority for offering liquidity and adjusting parameters alongside making changes in the private pool.

Contrary to a Private pool, a Public pool is fixed, meaning the parameters of a shared pool remain fixed, but anyone can add liquidity and trade. A finalized Balancer core pool with 80% ETH, 20% BTC, and a 0.1% fee will always remain that way.

At last, Smart pools use both of the above pool’s strategies and are controlled by automated smart contracts that function as a gateway for anyone to provide liquidity.

5. Kyber Network.

Kyber Network is the Ethereum based blockchain protocol powering its decentralized exchange and providing liquidity to DApps.

Kyber liquidity pool works completely differently from the rest of the protocols listed.

Instead of relying on the one AMM smart contracts to provide liquidity, Kyber is rely on a set of smart contracts that can be implemented on any smart contract capable blockchain, then the protocol aggregates the liquidity collected from various reserves like token holders, market makers, and decentralized exchanges, into a single liquidity pool on its network.

To execute a trade. Kyber network smart contracts look for the best available exchange rate on the reserves and then execute the trade.

Not only trading and swapping, when Kyber integrated into DApps, DeFi platforms, and crypto wallets, the Kyber Network had a wide range of use cases. For example, a DApp that would like to accept users who do not hold its native token can integrate the Kyber protocol to allow for in-app token swap and token conversion functionalities.

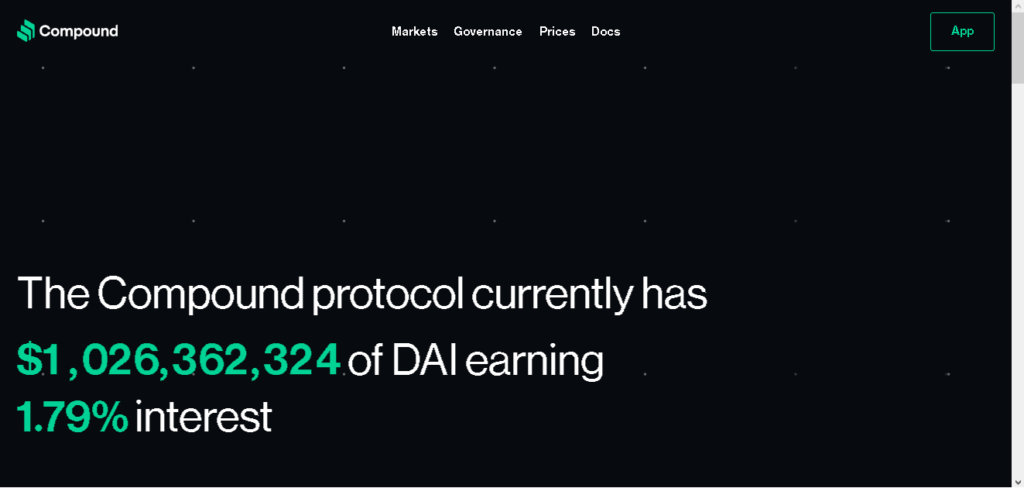

6. Compound.

Compound is a famous DeFi lending and borrowing platform using liquidity pools for operation.

So far on this list, you have known about liquidity pools consisting of two or more tokens facilitating platforms.

Compound liquidity pool consists of one token, which is enough for lending and borrowing on the platform.

Lending and Borrowing work simply. A lender lends the token on the Compound liquidity pool and receives interest for the deposit. In this case, the lender would not communicate with the borrower, but the transaction will happen between the lender and the smart contract on the platform.

For depositing liquidity to the platform, lenders receive cToken which acts as a receipt for the deposit, for example, if the lender lends BAT on the platform then the lender receives cBAT, and if the lender lends ETH then receives cETH.

cTokens are a form of derivatives that derive their value from the base asset deposited by the lender. The value of these cTokens increases over time as it accumulates the amount of interest.

Contrary to the lender, from the borrower’s perspective, borrowers also receive a token for the collateral deposited and the loan as the borrower’s requested asset. For example, if a borrower deposited ETH as collateral and received a DAI loan in exchange, then the borrower also received the cETH along with it. In the case of the borrower also, the transaction is between the borrower and the smart contract.

Conclusion.

Now you know what Liquidity pools are and how they play an important role in a decentralized economy.

Today many liquidity pools are operating, but I’ve tried to list different liquidity pools so that you can understand how liquidity pools operate differently, even having common traits.