Complete List of Cryptocurrency Friendly Banks

Still, the majority of banks in the world stay away from cryptocurrencies because of their decentralization nature.

We all know that banks are financial institutions that had some control over the funds.

But on the other hand, cryptocurrencies are not in favour of funds controlled by some centralized entities.

That’s why Banks heck even some Governments are not in the favor of cryptocurrencies.

As you know that the above situation is now turning out because now many Banks are stepping forward to utilize cryptocurrencies and blockchain technology for their and also their customer’s benefits.

In this post, we’re looking list of those crypto friendly Banks.

Goldman Sachs.

Goldman Sachs is an American multinational investment bank also one of the largest investment banking enterprises in the world.

This investment giant now become the most active investor in blockchain firms.

I want to make this clear that this Bank is not directly allowed to trade in cryptos but instead, they believe in investing and utilizing crypto and blockchain related startups.

Their Major Crypto Investments are:

Axoni:

It is a New York-based company specializing in the delivery of distributed ledger infrastructure to many of the world’s leading financial institutions, in 2018 their series B funding round along with others Goldman Sacks invested $32 million.

BitGo:

It is an American crypto wallet and blockchain security firm in 2018 Goldman Sachs and Galaxy Digital participated in BitGo’s series B funding round and both contributed $15 million.

Veem:

Veem basically a global payment platform utilizing Blockchain technology. In 2018 Goldman Sachs invested $25 million in Veem through its Principal Strategic Investment Group.

Tradeshift:

It is a cloud-based business network and platform for supply chain payments, marketplaces, and apps. They created Dai world’s first decentralized stablecoin based on the Ethereum blockchain. Goldman Sachs invested $250 million on the Tradeshift series E round.

Circle:

It is a peer-to-peer payments technology company which, helps individuals, institutions, and entrepreneurs to use, trade, invest and raise capital with open crypto technologies. Goldman Sachs is an early investor for Circle.

In 2018 November Goldman Sachs start utilizing Blockchain payment netting services developed by IBM and CLS (US forex exchange settlement giant).

Also, in 2018 rumours spread that they were planning to launch a crypto trading desk, but recently their CEO David Solomon clearly said they don’t have any plans to launch a crypto trading desk.

Barclays.

Barclay is a London based multinational investment bank. It is one of the largest banks in the UK.

This bank does not allow their customers to trade in cryptocurrencies directly, but they invested, partnered in crypto related companies and have some blockchain based patents.

In early 2018 Barclays partnered with Coinbase (One of the largest crypto exchanges in the world), this partnership allowed Barclays customers to create an account with Coinbase, making it easier for their customers to buy and sell cryptocurrencies.

Also, in the same year, they filed two different types of blockchain patents in the US.

The first patent is for Secure Digital Data Operations (this patent is about to transfer digital currency from sender to receiver in a secure way) and the second outline plans for Data Processing and Storage System using blockchain technology.

And in early 2019 they invested $5.5 million in Series A funding round for blockchain-based B2B payments startup Crowdz.

USAA (United Services Automobile Association).

USAA is the US-based famous fortune 500 company, their main services are banking, investing, and insurance to people and families who serve or served, in the United States military.

This Bank became the first United States bank to invest in cryptocurrency exchange.

They invested $150 million in Coinbase’s Series C round of funding.

This investment helps them to integrate with Coinbase this integration allows their customer to access Coinbase and view their crypto balance in the USAA app or website.

Note: USAA does not independently verify the information regarding Bitcoin wallets all those information provided by Coinbase and is accurate at the time retrieved.

Simple Bank.

Are you worried about your crypto deposits?. If yes then Simple Bank best option for you to deposit your cryptos.

Because, in Simple Bank, all deposits are insured by Federal Deposit Insurance Corporation.

US-based Simple Bank has been known as a supporter of cryptocurrencies, through its track record of working with a number of different cryptocurrency exchanges.

That’s why they allow all cryptocurrency transactions, even allow the direct buying or selling of Bitcoins.

Only one downside of this bank is. If you want to open an account with this bank then, you must be a citizen of the US, even American citizens living abroad are not able to open accounts with Simple Bank.

Monaize.

Monaize is a French m-banking platform that focuses on mobile-first current accounts for freelancers and small businesses.

This bank is an integrated banking platform for crypto and bank account users.

If you’re a freelancer or small business owner then, Monaize services will help you to do business in cryptos.

Not just crypto banking now they are looking to expand into other third-party services such as professional insurances, payment solutions, and crypto wallets.

Also, Monaize is popularly known for its instant KYB (Know Your Business) onboarding process, this process allowing users to create a business current account quickly with a smartphone.

In 2019 they will be expanding their services to the United Kingdom, Germany, and the United States.

Ally Bank.

Ally Bank is a US-based online-only bank that means they don’t have any branches that operate online.

Because they work online, they have 24/7 support, including online chat.

Plus, all deposits are FDIC insured.

Their integration with Coinbase allows customers to buy cryptocurrencies using their debit or credit card but, while using the cards customer have to pay a small fee to the bank.

These features make Ally Bank is a very convenient option for someone who wants a bank where they can also get involved with cryptos.

Fidor Bank.

This German-based bank is also following the online model to work.

Their initial integration with German Bitcoin exchange Bitcoin.de helped their customers to buy Bitcoins instantly through the bank.

Not only for buying if a customer is a holder of their Smart Giro Account then they also are able to make instant Bitcoin transfers to other Fidor Bank account customers.

In 2018 they announced integration with San Francisco-based crypto exchange Kraken, this integration helped them to become a fully functional altcoin bank.

Note: If you’re a customer of Fidor then, you will be able to trade on Kraken directly from your Fidor account.

Wirex.

Wirex is a UK based famous cryptocurrency cards, wallet, and banking service provider.

Their business is mainly focused on European countries but now they are issuing IBAN numbers to all account holders for doing international payments.

They also provide facilities to store and manage crypto portfolios.

With their instant trading platform, customers are able to convert their cryptos to British Pound, US Dollar, and the Euro fiat currencies at live rates.

Number one benefit you can get from the Wirex account is, you will get a 0.5% cashback in the form of Bitcoin whenever you use their debit card to make in-store purchases.

Bankera.

Can you imagine a traditional bank working with blockchain technology?.

Bankera is exactly doing that with blockchain technology.

This means Bankera uses blockchain technology and cryptoassets to provide traditional banking services.

The below video can give you a clear picture of Bankera’s services and working pattern.

Bankera is developed by a cryptocurrency exchange/wallet company SpectroCoin in 2017 and in 2018, they launched their own ERC-223 token BNK to fuel their operations.

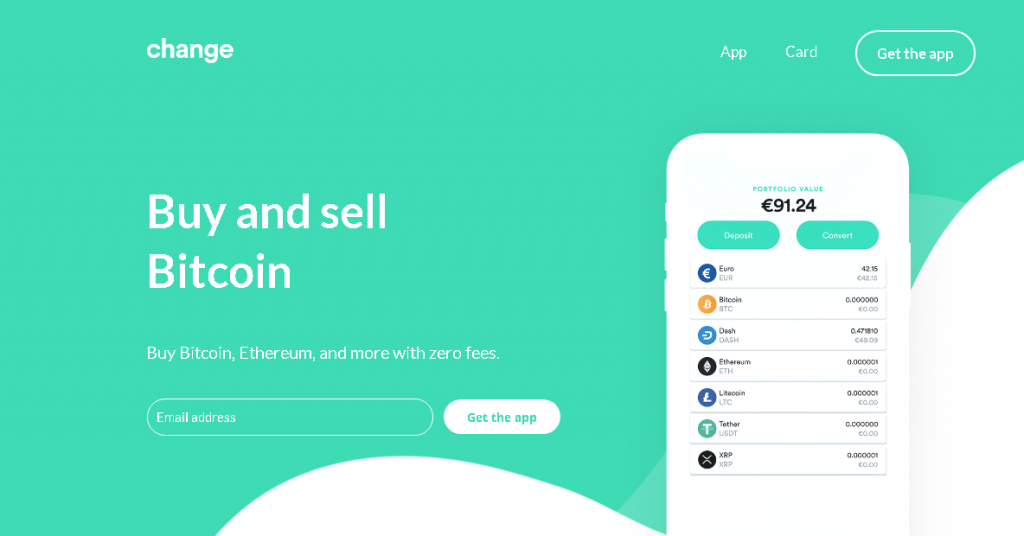

Change Bank.

Change is founded in 2016 Singapore but, now they work in the European Union.

Change working pattern is the same as Bankera’s.

One good thing about Change is you can trade Bitcoin, Ethereum, Litecoin, and Ripple without paying a fee.

Recently they launched a Premium account facility that allows customers to do unlimited trades and instantly liquidate their investments with banks Visa debit cards.

Also, they will start to offer stocks and tokenized assets such as gold, art, P2P loans, growth companies and much more.

Conclusion.

These are some banks that are involved directly or indirectly with cryptocurrencies.

This is a clear indication that in the future, many more banks will join this list.

Now tell me in the comment that, from this list which bank you have already used or going to use.

i live in the uk, and i would say revolut is more famous than wirex

Hey, I heard some bad things about Revolut, in the past, that’s why I am not including Revolut in this list.