Double Spending Explained Simply With Possible Solution

Double spending is a thorn in the side of all cryptocurrencies, causing headaches until Bitcoin came along with its game-changing solution.

Bitcoin tackles this head-on with its unique consensus mechanism.

But Hold Up, What Exactly Is Double Spending?

It’s when someone tries to spend the same cryptocurrency multiple times, opening the door to fraud and manipulation.

Unlike good old cash like the Dollar or Euro, where physical cash and big banks keep things in check, cryptocurrencies operate in the wild west of the digital realm.

For instance, when you drop a $100 bill at a diner, you can’t just turn around and spend that same $100 somewhere else. It’s locked up tight in the diner’s till. Even if you swipe your card, that transaction gets logged, so you can’t pull a fast one.

But in the crypto world, without a central authority or physical presence, sneaky folks can try to pull off double spending until Bitcoin swoops in with its fix.

How Did Bitcoin Solve the Double Spending Problem?

Before Bitcoin, no digital cash had quite nailed down the whole double spending thing. But then came Bitcoin, swooping in with its trusty solution: Proof of Work.

In this system, miners flex their computational power to confirm transactions. These confirmed transactions get bundled up into a block, joining a lineup of other confirmed deals. Then, the block gets slapped onto the blockchain, keeping a neat, chronological record of all the actions.

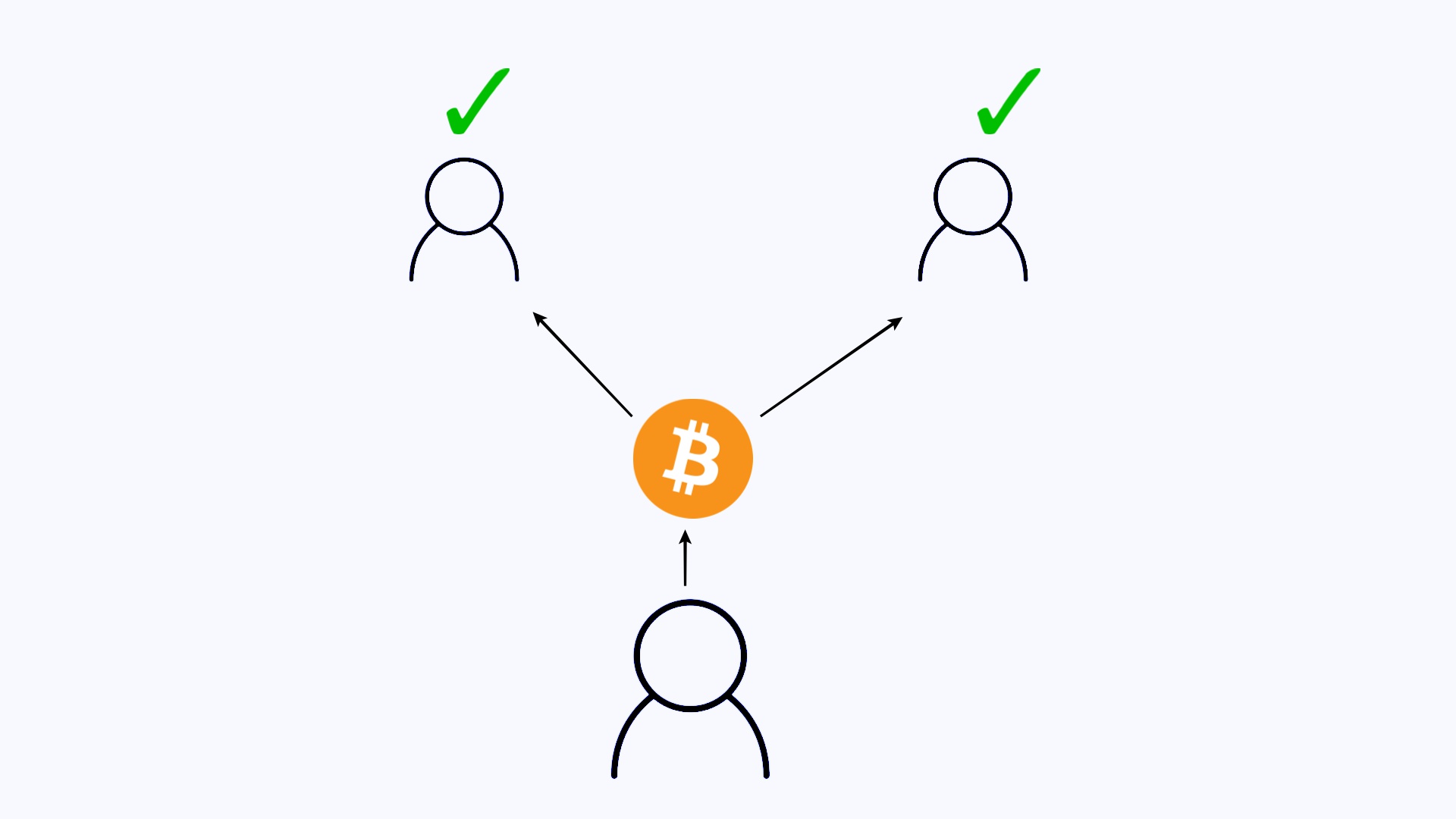

So, let’s say you send 1 Bitcoin to your buddy A. That transaction pops into the unconfirmed pool until a miner swoops in, gives it a thumbs-up, and tacks it onto a block. Other miners then chime in to validate the block by mining on top of it.

But what if you try to pull a fast one and send that same Bitcoin to your pal B right after?

Well, both transactions hop into the unconfirmed pool. But only the one to friend A gets the green light and makes it into a block. The one to friend B gets the boot.

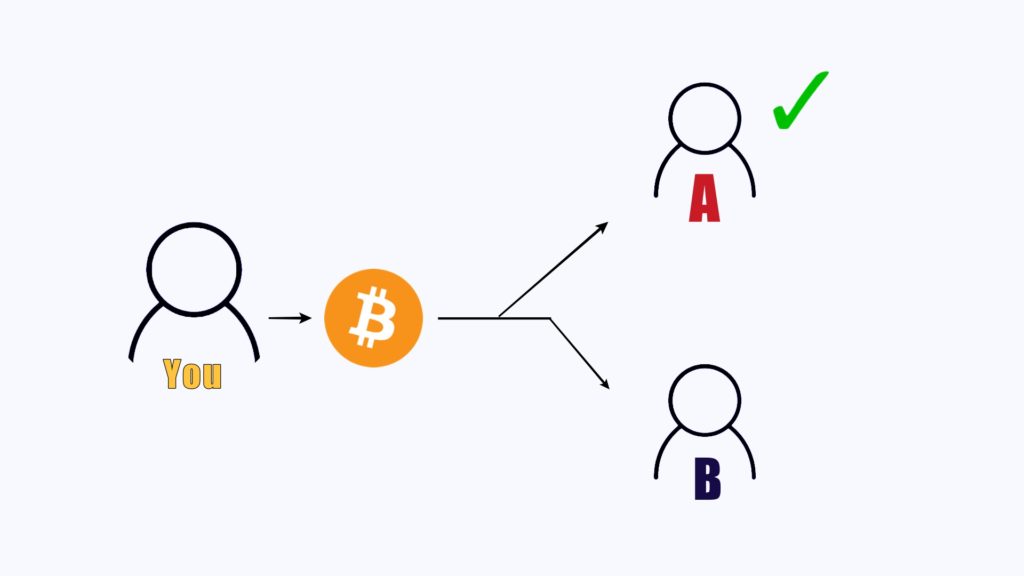

Now, what if you hit send on both transactions at the same time?

In that showdown, both transactions battle it out for miner approval. If transaction B gets the nod first, it’s game on.

But here’s the catch: For a transaction to be truly legit, it needs 6 confirmations. And since it’s super rare for both transactions to get 6 confirmations simultaneously, one usually comes out on top.

Sure, there’s a rare case of both transactions getting axed if the battle drags on too long. That’s why in the real world, merchants wait for enough confirmations before calling it a done deal on Bitcoin payments.

How Does Double Spending Happen?

There are primarily two reasons that facilitate double spending on the network.

1. 51% Attack.

Ever heard of the 51% attack? If a miner or group of miners grabs more than half of the network’s computing power, they can flip the script on transactions and make their own private blockchain. Which everyone considers real blockchain.

But pulling off this move on big-time cryptos like Bitcoin requires a massive amount of power and cost.

2 Race Attack.

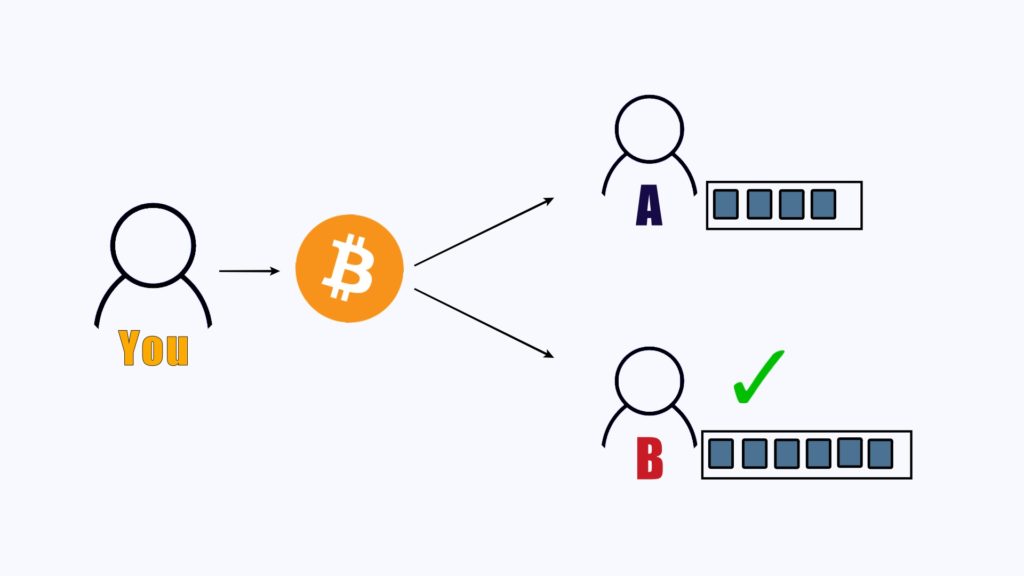

Now, onto the race attack. Here, the bad guy tries to pull a fast one by making two transactions with the same dough at the same time.

This is a headache for merchants who take unconfirmed transactions. Imagine this: a customer zaps the merchant with one transaction and themselves with another.

Remember, it’s all about those confirmations. Once a transaction racks up six of ’em, it’s the real deal. But if the customer gets confirmed before the merchant, well, the merchant will not receive any funds.

Possible Solutions for Double Spending.

Using Proof-of-Stake Instead of Proof-of-Work.

So, Proof-of-Work (PoW) has its flaws, especially when it comes to those 51% attacks. But it’s hard to do on the famous cryptos like Bitcoin.

But let’s face it, PoW isn’t foolproof. Just look at the Bitcoin Gold attack back in 2018. in the attack, miners gained control of the blockchain, enabling them to reverse transactions and cause significant financial losses.

These kinds of incidents, can create fear in a crypto holder and they may lose trust in the coin, but if a coin uses the Proof-of-Stake(PoS) mechanism this threat is solved easily.

Switching to a Proof-of-Stake (PoS) mechanism can mitigate this threat. In PoS, validators who hold a certain amount of coins on the network stake their assets to validate transactions. If malicious behavior is detected, validators risk losing their deposit, making such actions financially unviable.

Use Lighting Network to Transfer The Funds.

The Lightning Network is a layer 2 payment protocol that operates on top of a coin’s blockchain, enabling participants to transfer funds instantly.

With Lightning Network, merchants can serve up goods and services in a flash, no waiting for confirmations needed.

Conclusion.

Double spending remains a significant threat to the crypto space, despite Bitcoin’s efforts to address it.

Top cryptos are making the switch to PoS, while merchants and crypto buffs are getting in on the Lightning Network-enabled wallets and payment processors.

Spread the word, friend! Sharing is caring in the world of crypto.