Difference Between APR and APY

DeFi protocols highlight the APR or APY percentages to attract you.

At the first glance, both terms seem the same, but they’re not, and you can earn or save more if you know the exact difference between APR and APY in different scenarios.

Ok, let’s look at what APR and APY are, how to calculate them, and the exact differences.

What Is APR?

APR, a full abbreviation is Annual Percentage Rate, which is the interest rate that occurs annually on the principal amount.

If you lend the cryptos for APR, then you receive the fixed yearly rate of return, or if you borrow the amount, then you have to pay an APR annually.

Calculation of APR.

The calculation of APR is simple. If you lend $100 on the DeFi platform for 5% APR. After the year, you’ll receive $105, and the cycle will go on year after year where you receive a consistent $5 return every year; meaning the first year you receive $105, the second year you receive another $5 that makes $110, and the third year you receive another $5 making your investment $115. The same goes for borrowing, where you have to pay the interest amount.

Since the APR is an annualized rate, prorated interest will be charged if an investment or loan is held for a shorter period. For instance, a six-month investment with a 5% APR will yield only 2.5% of the principal amount.

What Is APY?

APY full abbreviation is Annual Percentage Yield, which is also a type of interest on the principal amount resulting in compounding.

APY is a flexible interest rate applicable on a yearly, half-yearly, quarterly, or even daily basis.

Under the APY method interest amount is added to the principal amount, and the installment interest is paid or received on the previous installment sum, resulting in the borrower paying more and the lender receiving a high return.

Calculation of APY.

In APY calculation of interest becomes a bit complex because of the different time periods in which interest is applied. Such as applying APY daily, resulting in more APY than the monthly and the monthly APY more than compared yearly.

For example, take the APR scenario applied to APY. Here you lend the same $100 for 5% monthly APY. In the first month, you receive $105, and in the next month, the 5% interest applies to the $105, so in the second month, you’re earning $5.25, making the principal amount $110.25. The same goes for borrowings.

In the APY scenario, the more frequent the APY means more returns or payments.

Difference Between APR and APY.

Measurement.

APR, as the name indicates, is the interest rate for over one year period.

On the other hand, in APY, there is no fixed time frame for interest rates. You can earn/pay interest on a daily or monthly or quarterly, or yearly.

Earnings.

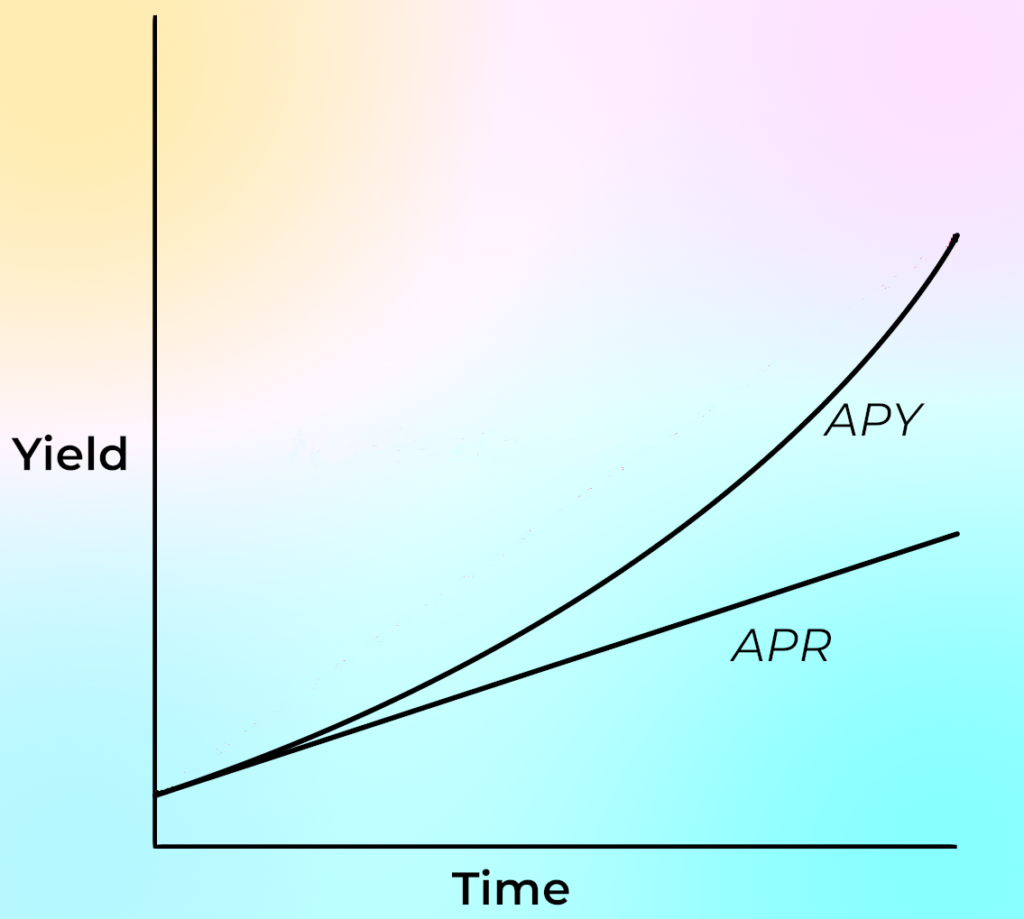

Return on APR is fixed and not compounding, resulting in fewer earnings over a long period.

Contrary to the APR, APY return is compounding and has a flexible time for interest rate resulting in more earnings.

For example, here is the chart showing how compound interest gains are more in the long run than the normal APR return.

Advertisement.

Promoting APR and APY in lending and borrowing platforms also differs.

You see, the APY is used most often in interest-earning accounts.

In borrowing, APR is used to set interest rates.

Conclusion.

Today APR and APY are widely used in the crypto world, especially in DeFi protocols, centralized exchanges (CEXs), and other finance-related crypto platforms, for a variety of lending and borrowing opportunities, liquidity pools, staking services, yield farms, and more. Most large DeFi and centralized crypto finance providers have products with both APR and APY rates.

But before you choose APR or APY, you should look for fees and costs that occur along with the APR or APY, and also don’t forget to check out whether the rate of APR or APY is variable from time to time with the market conditions or fixed.

Thanks.

You’re welcome.