Want a Crypto loan? Or Earn Passive Income From Crypto: Here Are Top 6 Crypto Lending Platforms

You have Crypto assets, and you desperately need money, you can sell those cryptos you’re holding and get money, but the problem is Crypto market is downtrend now if you sell your crypto holdings you book a loss.

Or you HODLing some crypto assets hoping the one-day market is skyrocket you book a large sum in profit but until that you just HODL your crypto not earning anything from it.

In both situations, you can use crypto lending platforms to get instant crypto-backed loans, or you can deposit your cryptos and earn interest from them.

The good thing about these lending platforms is you don’t need any credit history or FICO score and a lot of paperwork to get the loan also if your collateralized crypto worth increases you’re eligible to borrow more. But be aware that the vice-versa is also true !!.

Also, if you deposit your cryptos in lending platforms, you can earn up to an insane 14% return on interest.

But remember when it comes to financing and cryptocurrency, cybercriminals never miss their opportunity to make money, so there’s a huge amount of scams.

Here in this list, you get the most reliable crypto lending platforms.

#1 Nexo.

Nexo is founded in 2017, and backed by a European Fintech company Credissim.

They use BitGo, which custody carries $100 million in insurance protection to secure all crypto assets.

Plus, Nexo utilizes Onfido (trusted by Coinbase and similar platforms) for the strictest KYC and AML global compliance standards.

At the time of writing this post, with Nexo, you can earn 8% of interest on your crypto deposits, but they only accept some stable coins and don’t let you earn interest on Bitcoin, Ether, or Ripple.

The best part is, that interest is paid out daily and you can withdraw assets at any time.

Also, Nexo let you borrow from $1,000 to $2,000,000 for up to 1 year.

You can use their credit card to spend the loan amount also they let you withdraw the loan amount (partially or whole amount) into your bank accounts.

Before borrowing the amount, you must deposit crypto-assets into the Nexo platform account.

At last, Nexo gives you the option to choose LTV (Loan-To-Value) between 20% to 50% interest rate up to 11.9%.

#2 SALT (Secured Automated Lending Technology).

This platform only focuses on giving crypto-backed loans to its members.

SALT started to operate in 2017, and they’re the first asset-backed lending platform to give blockchain asset holders access to liquidity without them having to sell their tokens.

You can borrow starting from $5,000 up to $25,000,000 using the below crypto assets.

To get the loan, you have to verify your account with Know Your Customer (KYC) and Anti Money Laundering (AML) verification in SALT.

You will receive full collateral crypto deposits once the debt is cleared. If repayments aren’t made, then your collateral is taken as a normal loan. This is done by selling a necessary portion of your cryptocurrency to cover the missed payment.

They use a cold storage method to store your all collaterals also you can utilize the Multi-Signature process to add another layer of security.

The uniqueness of SALT is all its activities are automated, and you get real-time system reports of your loan health (loan-to-value ratio) throughout the life of your loan.

SALT gives you the option to choose LTV from 30% – 70% with an interest rate of 5.95% for up to 12 months.

#3 Celsius Network.

Celsius Network is the peer to peer crypto lending company operating since 2017.

They allow you both borrowing money using crypto as collateral and deposing cryptos to earn interest.

This platform only focuses on mobile users. You can download their app in the App Store and Play store.

As Nexo, they’re also using BitGo to secure all crypto assets.

If you deposit your crypto in Celsius you can earn up to $5,000,000 there is no minimum balance required for depositing.

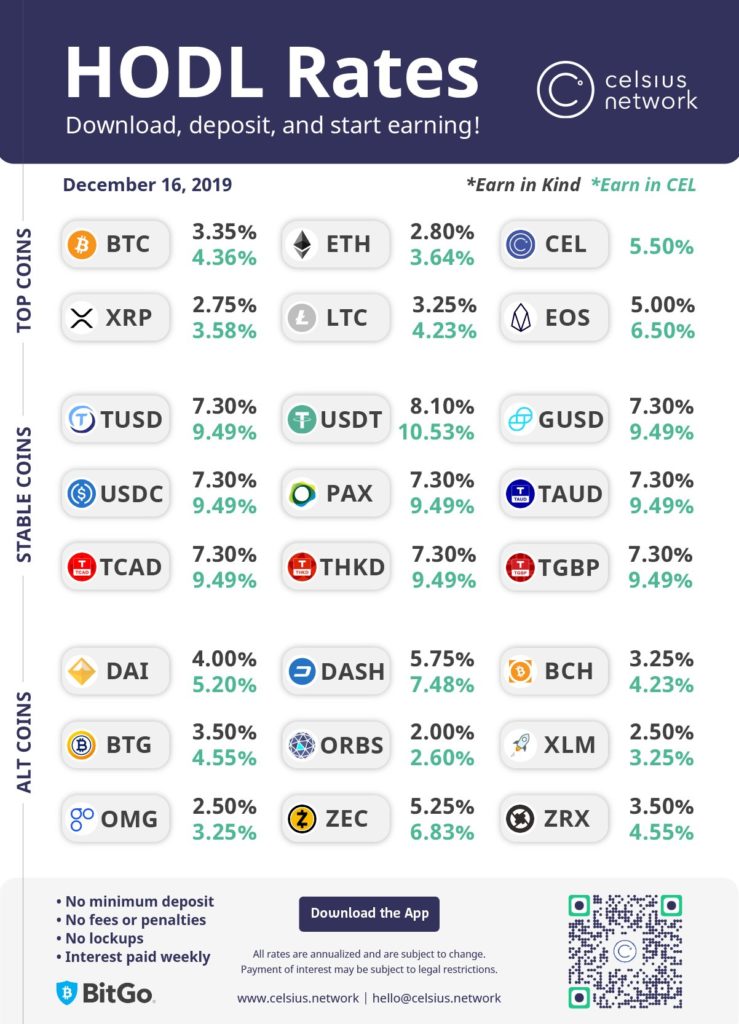

As a lender, if you chose to get your weekly interest on CELL (their native token) you will receive more interest on all non-CELL deposits.

You can borrow a minimum of $1,500 using Bitcoin(BTC), Ethereum(ETH), BitcoinCash(BCH), Ripple(XRP), Litecoin(LTC), or Dash as collateral, there is no maximum limit.

At Celsius, you can get loans up to residency of up to 3 years at LTV of up to 50%.

If you maintain a certain level of CELL token balance in your Celsius account then, you can get up to a 25% discount on the interest rate on borrowing.

One spectacular thing about Celsius is there are no withdrawal fees, no deposit fees, no transaction fees, no early termination fees, and no origination fees.

#4 BlockFi.

BlockFi is a USA based company operating since 2017.

They offer both crypto-backed loans and crypto investments.

The company runs in compliance with the USA’s federal laws, and they use Gemini a depository trust and licensed custodian for storing your crypto assets.

To open an account in BlockFi, you need to enter your KYC/AML information for identity verification purposes.

They offer up to an 8.6% interest rate annually only for depositing Bitcoin(BTC), Ethereum(ETH), and Gemini Dollar(GUSD). The interest is compound monthly and can give up to an 8.6% annual return.

With BlockFi, you can take a minimum $5,000 loan using Bitcoin(BTC), Ethereum(ETH), and Litecoin(LTC) as collateral for one year.

The Loan interest rate starts at 4.5% annually with a minimum of 50% Loan-To-Value. However, interest rates may vary with the loan amount, LTV selection, and loan duration.

#5 YouHolder.

YouHolder is a Switzerland company founded in 2018.

They provide both crypto loans and investment services.

YouHolder requires your ID verifications for completing the signup process.

Compared to other lending platforms from above YouHolder is the youngest but they stand out from all by providing up to an insane 90% Loan-To-Value for your crypto collaterals.

Higher LTV means you can borrow more money, as it more closely follows the value of the digital assets you use as collateral.

To get a crypto loan, you can use 14 cryptos (BTC, ETH, BNB, XRP, XML, LTC, BCH, BSV, DASH, EOS, EOS, LINK, BAT, and REP) as collaterals and get the loan amount in USD or EUR to directly your bank account.

The loan amount starts at a minimum of $100 and up to 120 days.

YouHolder offers three plans for getting crypto-backed loans.

On the investment side, YouHolder gives you 7.2% annual returns for the Bitcoin saving account and 12% for the Stablecoin savings account. YouHodler also provides crypto to crypto, crypto to fiat, and fiat to crypto conversion.

You don’t have to worry about the security of your crypto because in YouHolder all crypto operations run accordance with Cryptocurrency Security Standard (CCSS) and they run external security audits regularly.

Join YouHolder with this link to get Instantly $25 bonus while taking the loan.

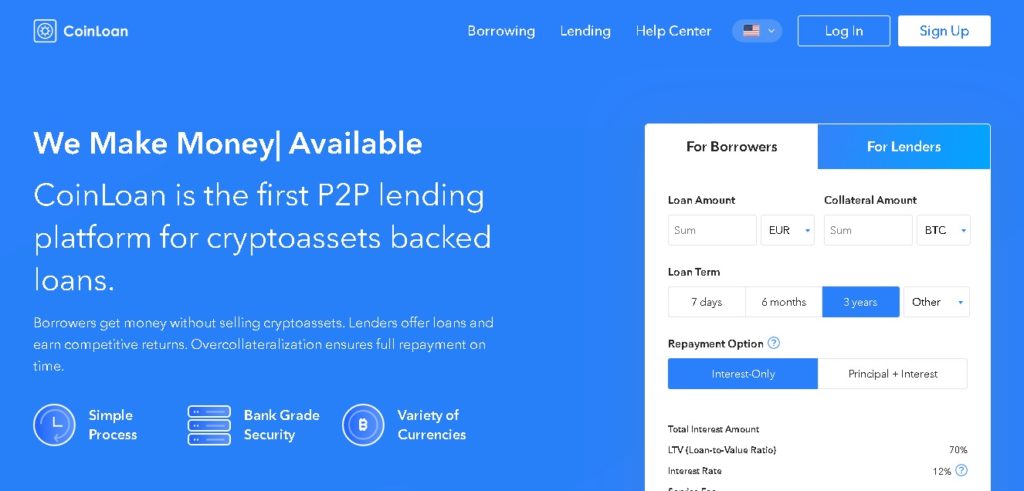

#6 CoinLoan.

Like Celsius, it is also a peer-to-peer lending platform based in Estonia founded in 2016.

CoinLoan allows you to borrow money using cryptos as well earn interest on your crypto holdings.

This is a P2P platform which means borrowers get money without selling their cryptoassets, while lenders offer loans and get competitive returns. Borrowers need to overcollateralize, and this over-collateralization requirement means lenders receive full repayment on time.

CoinLoan allows you to borrow a small amount $50 using BTC, ETH, LTC, XMR, CLT, and CNT as collateral for up to 3 years with 70% LTV and interest 10%. You can withdraw the loan amount instantly in your bank.

Also, you can deposit your crypto in CoinLoan earn compounded monthly interest up to 8%.

At the time of writing this post, they allow you to deposit BTC, ETH, and stablecoins like USDC, USDT, and PAX.

And you don’t have to worry transactions on the platform are highly secure with SSL protocol and additional security measures. It also has the infrastructure and legal status to ensure the security of funds. Furthermore, CoinLoan has all of the licenses required to operate legally as a European company.

These are all the best crypto lending platforms you can utilize to borrow money or earn interest using your crypto.

Conclusion.

Crypto lending is now grabbing more attention and now becoming the mainstream conversation for banking experts and institutional investors.

This arm of decentralized cryptocurrencies is called decentralized finance (De-Fi).

Now, which platform do you choose for both taking the loan and earning interest using your crypto.