Best Crypto and Blockchain ETFs to Look In 2023

The cryptocurrency market still has not reached the level of the traditional stock market, even having the advantages like decentralized, almost global presence, 24/7 availability.

The main reason cryptos are not winning the race is the crypto market is a new emerging market backed by technology, so a common person who learned traditional finance having a low technical background is not able to understand the crypto market as easily as a person who has the technical background.

But as the year’s pass, cryptos make changes like DiFi, where blockchain platforms make drastic changes in the crypto market by introducing traditional financial market products like Tokenizing Stocks to attract traditional market investors.

For someone who doesn’t want to leave the traditional market, crypto ETFs are a hot thing attracting more heads in the traditional market.

What Are Crypto ETFs?

ETF full abbreviation Exchange Traded Fund which are financial products that track underlying assets.

Don’t confuse ETFs with index and mutual funds because you can buy and sell ETFs throughout the day with a minimum investment. You can even buy a fraction of shares rather than investing in the whole fund.

ETFs related to cryptos or blockchain track many crypto assets or companies involved in crypto activities for helping the passive investors who do not have time to consistently monitor the market, so buying an ETF can solve the problem of holding all the assets they wanted to.

And also, crypto ETFs trade on traditional market exchanges rather than cryptocurrency exchanges eliminating the additional procedures for signup to the crypto exchanges.

List of Crypto and Blockchain ETF.

Siren Nasdaq NextGen Economy ETF (BLCN).

BLCN launched in 2019 and has more than $280 million assets under management.

In BLCN, more than 80% of funds are invested in companies that are committing material resources to developing, researching, supporting, innovating or utilizing blockchain technology.

Some of the fund’s top holdings include shares of Coinbase, IBM, NVIDIA, Microsoft, Square, Accenture, Microstrategy having an expense ratio of 0.68%.

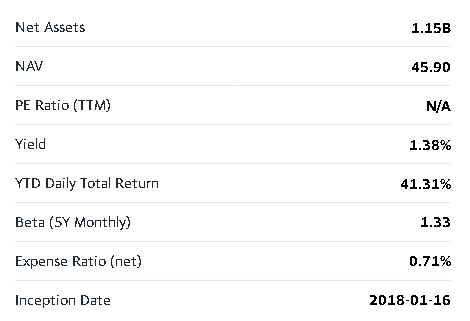

Amplify Transformational Data Sharing ETF (BLOK).

BLOK ETF has been in the market since 2018, managing more than $1 billion.

The fund invests at least 80% of funds in companies actively involved in the development and utilization of blockchain technologies. These companies include Coinbase, Microstrategy, Square, Nvidia, Riot Blockchain.

This ETF has an expense ratio of 0.70%, and the rest of the data is in the image below.

First Trust Indxx Innovative Transaction & Process ETF (LEGR).

LEGR ETF has been in the market since 2018.

The ETF tracks the Indxx Blockchain Index, which is designed to track the performance of companies that are either actively using, investing in, developing, or have products that are poised to benefit from blockchain technology and has holdings in 100 companies. These companies include Baidu, Inc. (BIDU), Micron Technologies (MU), AMD, Nvidia.

This ETF has an expense ratio of 0.65% and has assets under management of over $100 million.

Innovation Shares NextGen Protocol ETF (KOIN).

KOIN ETF has been available in the market since 2018 and tracks Innovation Labs Blockchain Innovators Index.

The Index has holdings in 43 companies that are involved in the blockchain space. These companies include Microsoft, Nvidia, Intel, PayPal, Oracle.

Currently, the ETF has 31 million assets under management and a 0.65% expense ratio.

Purpose Bitcoin ETF.

Purpose Bitcoin ETF is the first Bitcoin ETF backed by physically settled Bitcoin launched in 2020 by purpose investment Inc.

The ETF invests directly in physically settled Bitcoin, not derivatives, allowing investors easy and efficient access to the emerging asset class of cryptocurrency.

All the bitcoin holdings are in cold storage without the risk of trading at large premiums to the value of the ETF’s underlying bitcoin holdings.

ETF kicked off with a $590 million asset under management, having a 1% management fee.

VanEck Vectors Digital Transformation ETF (DAPP).

DAPP ETF tracks the MVIS Global Asset Equity Index, which tracks the performance of the largest and most liquid companies.

The companies include Coinbase, Square, Microstrategy, Hive Blockchain technologies and many others, having at least 50% of their revenues from digital asset exchanges, payment gateways, mining operations, software services, equipment and technology or services in the digital assets industry.

The ETF has $32 million assets under management with a 0.65% expense ratio.

Bitwise Crypto Industry Innovators ETF (BITQ).

Bitwise Crypto Industry Innovators ETF is the new ETF on the market launched in May 2021.

The ETF tracks Bitwise Crypto Innovators Index, of which 85% focuses on companies actively involved in the crypto activities such as mining, trading and services providers; the remaining 15% is allocated towards large-cap firms with at least one significant business line focused on the crypto economy.

Currently, the ETF handles $71 million funds with an expense ratio of 0.85%.

Conclusion.

These are all the ETFs you can consider investing in if you don’t want to invest directly in cryptos.

But as usual, don’t forget to do your own research before making any investment move. Who knows, you can even find more crypto or blockchain ETFs.

If you find this post helpful, do share it with your family and friends.