Top 6 Best Crypto Derivatives Exchanges

Today, cryptocurrencies are more than just digital assets for transferring or storing value; they’ve become essential tools for trading, fundraising, and much more.

As crypto trading gains popularity, spot trading remains a prevalent method. However, with the rapid growth of the crypto market, many exchange platforms have introduced derivative trading.

Crypto derivatives are financial instruments that mimic cryptocurrency prices without actually owning the assets. This makes it easier for traders to track price movements and develop investment strategies. However, it’s crucial to note that derivatives exchanges typically offer leverage, which can increase market volatility.

Understanding how leverage and derivatives function is essential before delving into derivative trading. Moreover, choosing the right platform is crucial. That’s why in this post, I’m highlighting some of the best platforms that enable traders like you to engage in crypto derivatives trading.

1. Binance Future Account.

Operating since 2017, Binance is a popular spot trading crypto exchange in the world.

In 2019 they launched a Crypto Perpetual futures and margin trading platform.

Firstly, to attract users, they offered the opportunity to margin trade up to 24 different crypto pairs in the futures market with leverage as high as 125x (the highest leverage ever offered in the crypto market).

Also came up with the two-factor authentication, user-friendly UI, and analytic tool features that quickly made the platform popular.

Plus, their fee structure is appealing, with no deposit fees, a 0.04% fee for both takers and makers on each trade, and a withdrawal fee of 0.0005 BTC for all derivative traders.

2. BitMEX.

BitMEX, established in 2014, is the oldest exchange focusing solely on crypto derivatives, particularly Bitcoin derivatives.

Owned by HDR Global Trading Limited and operating from Hong Kong and Bermuda, BitMEX allows users to trade various financial products with leverage of up to 100x.

Although BitMEX is a P2P exchange it allows users to buy digital currencies (Ethereum (ETH), Bitcoin Cash (BCH), Cardano (ADA), EOS (EOS), Litecoin (LTC), Ripple (XRP), Tron (TRX)) only through Bitcoins and to trade financial products such as Perpetual Contracts, Future Contracts, Up Contract, and Down Contracts with up to 100x leverage among themselves.

Furthermore, for expert traders, BitMEX offers a variety of orders such as Market Orders, Limit Orders, Stop Orders, Take Profit Orders, and Hidden Orders.

For all these services BitMEX charges a fee depending on the type of order (contracts/futures) and the chosen cryptocurrency. For the traditional future when trading in Bitcoin, Market takers pay 0.075% per trade, and makers get a 0.025% rebate. This is a refund given to makers for providing liquidity for the platform.

To ensure the safety of customer funds, BitMEX uses the cold storage multi-sig wallet which requires two BitMEX employees’ verification before making the withdrawal.

3. Phemex.

Phemex is the fastest-growing derivatives exchange on this list started in 2019 with a leadership team boasting over 8 former Morgan Stanley Executives.

Exchange is especially known for its speed of handling transactions. Phemex can handle a staggering 300,000 transactions per second.

Like Binance it also offers both spot and derivatives trading but at derivative trading, Phemex offers its own perpetual contracts that include BitcoinUSD which means the pair trades Bitcoin to its current price in US dollars, and also offers various other cryptocurrencies pairs, including popular choices such as Ethereum and XRP (Ripple) to USD with up to 100X leverage. However, the exchange also features support for less commonplace cryptocurrencies, such as ChainLink, Litecoin, and Tezos.

Another feature that makes Phemex stand out from others is the Sub-account feature. Using this feature you can create separate sub-accounts within their main account which allows you to isolate different trading strategies, account balances, and permissions.

For providing security for the funds Phemex uses the Hierarchical Deterministic Cold Wallet System (HDCWS) which assigns an independent deposit address to each user so that all assets are kept in cold wallets.

In exchange for all the services, Phemex uses a 0.0075% taker fee and a 0.0025% maker rebate. These fees apply To all the different trading pairs on the Phemex exchange.

4. Deribit.

Like BitMEX, Deribit also focuses only on derivative trading.

The big difference between BitMEX and Deribit is that Deribit is not a P2P exchange and offers perpetual, futures and options for Bitcoin and Ethereum with possible leverage of 100X.

Started operation back in 2016 from the Netherlands and recently moved to Panama due to the strict laws in Europe.

Deribit is known for its technical advancements such as allowing users to trade via their trade matching engine with less than 1MS latency and dashboards for trading history, recent trades, and order books also integrates with trading bot software such as HaasOnline, BotVS, and Actant.

For providing better security for your funds, Deribit uses the cold wallet as the above platforms also provide 2FA support for user accounts.

As for fees, Deribit charges between 0.05% and 0.075% for takers and rewards makers with 0.2% to 0.25%. Withdrawals? A flat 0.0006BTC fee, with deposits, withdrawals, and trades all in BTC.

5. OKX.

This Hong Kong-based exchange started operation in 2017 since the beginning OKX (formerly known as OKEx) maintained being one of the reputed crypto exchanges in both spot and derivative trading.

Don’t just take my word for it—crypto price tracker CoinGecko crowned OKX as the No.1 derivative exchange.

OKX really deserves the position by offering complete derivative trading options in both perpetual swaps, futures, and options with leverage of up to 100x, depending on the type of financial instrument.

To trade on futures OKX offers two types of contracts one coin-margined future and other USDT-margined futures, Perpetual swaps are available for 23 different cryptocurrencies lastly options in three different contracts.

One feature that makes the OKX stand out from others on the list is they do not allow everyone to trade on derivatives; they allow only those who pass the quiz about derivatives.

OKX puts security as its priority so it supports a few key features that guarantee security for you, such as combining cold storage, private key generation, and backups. Also, 2-factor authentication, mobile verification codes for withdrawal, changing password and security settings, and Anti-phishing codes with every email from OKX.

In exchange for all these services, OKX offers a low fee based on average 30-day trading volumes in different tiers. You can view the complete fee structure on their fee page.

6. Bybit.

Bybit is the Singapore based P2P crypto derivative exchange operating since 2018.

They focus on the products of the perpetual futures in four derivative pairs, including BTC, ETH, XRP, and EOS. These crypto-assets are all paired against the USDT with leverage up to100X.

Now, here’s the deal: Bybit is a P2P exchange, so it’s crypto funding only. No credit cards or wire transfers here.

Also, they claim that the platform can process 100,000 transactions per second.

But the stand-out feature of Bybit is mutual insurance funds whose main intention is to manage the risk posed by shortfalls in a futures contract settlement.

In simple terms, when a liquidated order is closed at a price worse than the bankrupt price, Bybit uses the balance of the Insurance Fund to cover the gap. Here, Auto-Deleveraging is only triggered when the Insurance Fund is insufficient.

For maintaining the user funds securely Bybit uses the cold storage method and also has a multi-signature address scheme.

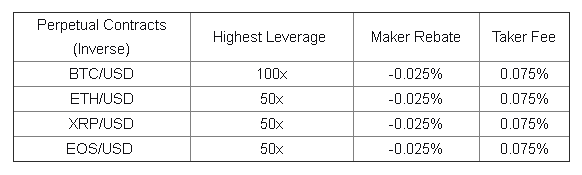

Their fee structure is the same as BitMEX for BTC but slightly above for ETH (as they propose higher leverage for it), you can check out the fee in the image below.

Conclusion.

So, there you have it—the top dogs in the world of derivative trading.

But as I mentioned earlier in the post before diving into the trading you should acquire the basic knowledge and then choose the one exchange that has the same feature as what you’re looking for from the list.

To make your decision easy. I highlighted every exchange’s unique feature, so now it’s your turn to choose one from the list.

And don’t forget to mention your choice in the comment section which may help others to make the decision.

Also, if you got any valuable insight from the post, don’t forget to share it with family and friends.