List of Top Cryptocurrency Debit Cards in 2024 [Updated]

Cryptocurrencies are now ubiquitous, permeating nearly every industry, and the revolutionary technology behind them is gaining widespread adoption.

In the coming years, cryptocurrencies are poised to become invaluable on Earth, fostering growth across various industries and improving the lives of many individuals.

That’s why now cryptocurrencies like Bitcoin and Ethereum are catching more eyeballs from technical and financial aspects.

Among the various methods of providing crypto services, debit cards stand out as one of the best options,

Debit cards are universally familiar making them an accessible choice to close.

Here I listed some best crypto debit card providers in 2024.

1. Wirex Cryptocurrency Debit card.

Wirex, formerly known as E-coin, rebranded in 2016.

The Wirex crypto debit card is popular within the crypto community and is available in both physical and virtual forms.

This means you can open a

The Wirex card can be used to spend crypto at any store accepting Visa.

Pros

This card instantly supports Bitcoin, Ripple, Ethereum, and Litecoin.

Also, the Wirex card has the Pound sterling (GBP), Euro (EUR), and Doller (USD) fiat money options.

Cons

This card has no delivery charges, but you have to pay €1.20/ £1.00/ $1.50 per month for administration and operational costs, which means this card seems to be a little bit expensive.

The registration process for this card is not anonymous.

Despite all these good and bad things, Wirex

Also, they have a

Interested in buying Wirex? Then Buy Now.

2. Uquid Debit Card.

If you noticed above list of cryptocurrency debit cards only supports selected cryptocurrencies like Bitcoin, Ethereum, or Ripple.

This debit card supports an impressive 90 cryptocurrencies!

Uquid is a UK-based company founded in May 2016 by Tran Hung.

The card is available in both physical and virtual form, you can load GBP, EUR, or USD to a card, for making transactions.

Pros

You already know that this card supports a vast number of cryptocurrencies also they promise you to deliver the card free within 2 or 3 working days to 174+ countries.

This card does

Uquid provides you with unlimited ATM withdrawals.

Cons

The major drawback of this card is, that you have limited ATM withdrawals only six crypto purchases per day (unless you upgrade your account by providing more personal information).

The Uquid debit card is not distributed by Visa, because their contract with Visa is terminated in 2017.

Buy Uquid Debit Card In 2 Clicks.

3. BitPay Bitcoin Debit Card.

BitPay is a Bitcoin payment service provider headquartered in Atlanta, Georgia, United States.

It was founded in May 2011 by Tony Gallippi and Stephen Pair.

As the name suggests, it is a Bitcoin debit card for US residents and is a famous bitcoin debit card in the US.

They offer both physical and virtual card forms; in the virtual card, you can load GBP, EUR, and USD.

This is a Visa debit card, which means you can use this card at any store that accepts Visa.

Pros

It is available in all 50 US states. You must have a home address, government-issued ID, and Social Security number to apply.

There are no transaction fees for this card.

Cons

This card supports only Bitcoin transactions.

If you’re using this card outside of the US then, you will need to pay a 3% conversion fee. If you withdraw money from your Bitpay card then, you will pay a $2 fee ($3 outside the US).

There are also additional deposit and mailing fees included.

You already know that this card is only available for US residents, but in recent developments, BitPay announced that they expanding to Europe and many other countries.

4. CryptoPay Bitcoin Debit Card.

CryptoPay founded in October 2013, is a cryptocurrency wallet and payment platform.

They issue a Bitcoin debit card that offers low commission fees and free worldwide delivery.

The debit card is available in both physical and virtual forms.

This is also a Visa debit card meaning you can use this card where Visa cards are accepted.

Pros

You don’t need any ID verification to order this card.

They offer a low commission that includes a monthly fee of $1 a 1% charge when you convert your bitcoin, and free worldwide delivery.

Cons

This card only supports Bitcoin as a payment option.

CryptoPay services are only available in the UK, Europe, and Russia, but they are planning to expand to Singapore and many other countries.

You already know that this card doesn’t need any ID verification, but if you want to access more features, then you have to give your full identification details.

Order a CryptoPay Debit Card For Free Now.

5. MCO Visa Card.

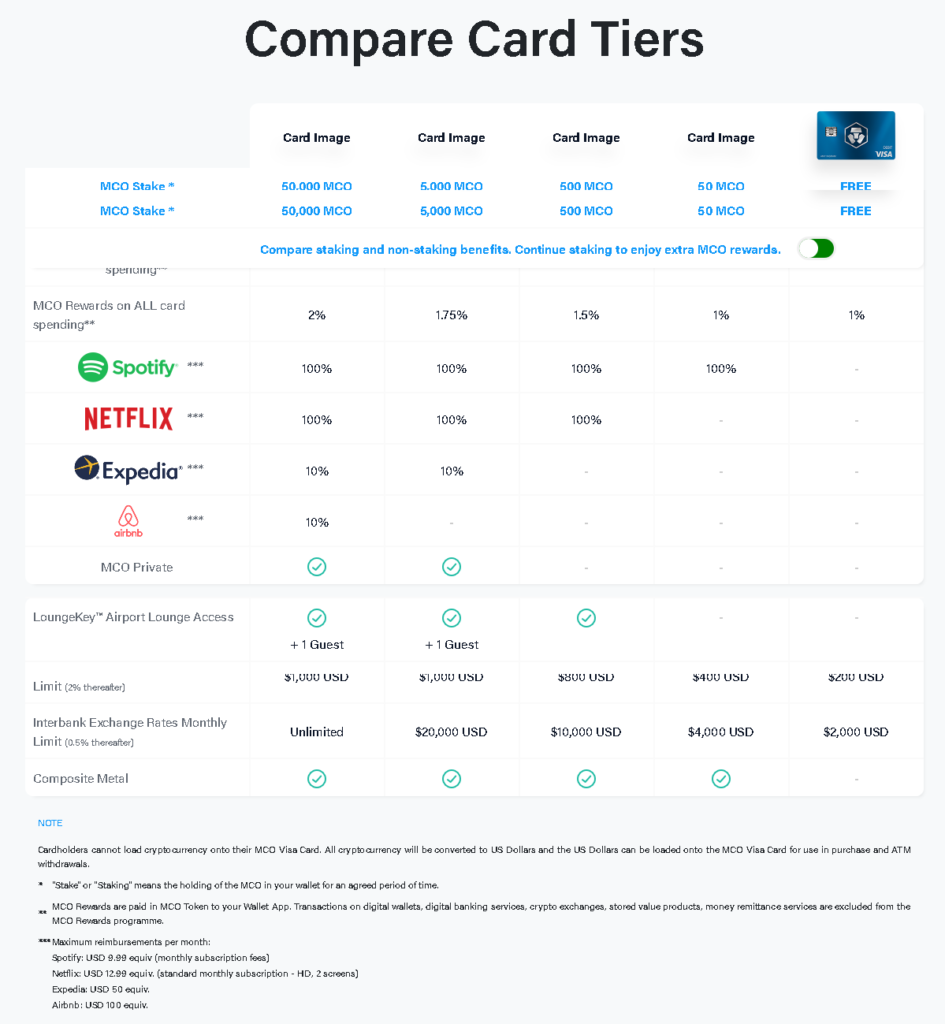

If you like to have a crypto debit card that doesn’t have any monthly, annual, or issuance fees then, an MCO Debit card is for you.

MCO Visa Card is a rebranding of the Monaco Card issued by Crypto.com.

As I mentioned above, to buy this card you don’t need to spend any extra money plus you receive a minimum of 1% cash back on all your purchases.

If you purchase their native MCO coin and hold it for 6 months or above then, you’ll get extra cashback on Spotify, Netflix, Airbnb, and Expedia, even unlimited airport lounge access without any spending commission and maximum deposit requirements.

However, they charge for direct ATM withdrawal a 2.00% fee only if the ATM withdrawal exceeds USD 200.

All their fees and cashback details are below the image.

Currently, you can get an MCO card only in Singapore and the US soon they expand availability to the EU and Australia.

MCO Visa Card supports many cryptocurrencies like Bitcoin, Ethereum, Monaco Coin, and Binance Coin, and fiat currencies like USD, GBP, HKD, EUR, JPY, SGD, and AUD.

Also, it is a Visa Card which means it is accepted everywhere in the world.

Pros

No extra commissions or fees.

Instant Crypto to Fiat conversion.

Unlimited free currency conversions at the interbank exchange rate.

Lots of cashback offers.

Live Chat support.

Variety of options.

Cons

To get an MCO card you have to provide ID verification documents.

Their Wallet withdrawals get days to Withdraw.

To get more cashback you have to purchase their MCO coins which will cost you more than $100,000.

Ok, these are all trustable cryptocurrency debit cards, but before you purchase any crypto debit cards, you should know some of these important factors.

Before You Buy, Know These Things.

Many companies and startups are providing crypto debit card facilities.

Before you choose to buy a debit card, you must know the background of the service provider, which countries they serve, and whether their software is bug-free or not.

If you’re buying from any startups, then you will have to investigate their funding backgrounds.

And, it is better to buy MasterCard or Visa crypto debit cards because of security and acceptance reasons.

Now I would like to hear about your experience of using a

If you have any points to add mention those in the comments.

If you like this article, then feel free to share it with your family and friends.