What Is Initial Exchange Offering (IEO)? How It Differ from ICO, and It’s Benefits

Every crypto asset is not a Bitcoin or Ethereum, to become popular, they need initial financial support to push them to another height.

Crowdfunding is the best way to a raise large amount initially.

In 2017-18 when the crypto market is booming new crypto projects raised a large amount of funding through a crowdfunding process called ICO, but after 2018 ICOs are fading, and a new fundraising method IEO is emerging.

Before understanding IEO, let’s look at what is ICO, to get a clear picture of IEO.

What is ICO?

ICO’s full form is Initial Coin Offering. It is the crowdfunding process where a crypto project attracts investors when launching its new Coin or Token.

Investors buy these Coins or Tokens using their Fiat money or project parent Cryptocurrency hoping this new Project brings them great profits in the future.

In the ICOs, the crypto project issue whitepapers (details about coins or tokens) to gain the trust of potential investors, and it is open to the public means anyone can participate in it.

What is IEO?

Now you understood the ICO but IEO (Initial Exchange Offering) has a small difference from ICO.

Here crypto project issues their coin or token in a crypto Exchange instead of going public to raise initial money.

Crypto Exchange creates a specific platform dedicating IEOs. Using this platform interested members of that exchange can participate in IEO.

Every IEO is conducting on Exchange is reviewed by the exchange to make sure that the project is worthy and authentic to its members because of exchange’s reputation is on the line.

Also, as compared to ICO, in IEO participants just have to create an account on the exchange’s platform, where the IEO is conducted instead of researching on their own to find a legit crypto project.

Difference Between ICO and IEO.

There is a small difference in Initial Exchange Offering that makes it stand out from Initial Coin Offering.

Platform.

In ICO, anyone can participate it is open to the public.

But as Exchange Offerings name states that only particular exchange members are allowed to take part in initial fundraising.

Procedure.

To take part in ICOs, investors have to go through the signup procedure set by the project, sometimes they even ask for ID details or to fulfill the KYC procedure.

Here in IEO, investors just need to log in to exchange for taking a part in fundraising.

Trust.

If we look at the history of ICOs, there are 99% of ICOs are ripped off the investor’s money and run away, because of no trusted third party involvement in the process.

Until now 99% of Exchange Offerings are conducted successfully, even though 1% of projects are laid down or dropped by the exchanges because the project is not authentic to their members, as I stated earlier when conducting IEO exchange reputation on the line, that is why they have to approve authentic IEOs if they intended to stay in the market for a long period.

Risk.

Investors have to collect the ICO project details before investing for ensuring authenticity that is why investors bear high risk while investing in ICO.

But in IEO exchange is already examined for the project authenticity for the investor they just need to invest if they believe that project is worth investing.

Funding.

In ICO, the project mints its tokens once the funding gets completed.

In the case of IEOs, projects generate tokens and send them to the exchange platform.

Marketing.

Crypto Startups have to reach more people through many marketing campaigns if they want to collect huge funding.

In an IEO, a startup just needs to gain the trust of the exchange or exchanges to launch their initial funding offer, and exchanges took all the marketing responsibilities to reach their customers.

These are some differences that make an Initial Exchange Offering stand out from Initial Coin Offering.

Benefits of IEO.

#1 By introducing third-party IEO made the crypto fundraising process easier and safer for investors and project developers.

#2 Developers don’t need to reach out to investors directly by doing expensive marketing campaigns here in IEO exchange list their project on its platform to developers gets fund from the already existing user base.

#3 Listing the project tokens or coins on exchanges would be more comfortable after hosting IEO, making the process less difficult for all the parties involved in the exchange.

#4 IEOs are the most profitable for the Exchange sites. They attract the new user to the platform in the name of IEO also they gain more user base to their native token or coin by offering special rates for those customers buying into IEOs using the exchange’s own token or coin, plus exchanges charge some fee to projects for listing an IEO on their platform.

Until now, IEO seems to be a great way to invest in a crypto startup. However, before you want to invest in IEO to become a crypto startup investor, I recommend you look at the downside of IEO as well.

Drawbacks of IEO.

#1 The exchange could promote a shady IEO project because they’re getting a high commission from IEO project developers.

#2 Here in Exchange Offering, an exchange oversees the process, it simply controls the revenue flow, while blockchain and cryptocurrency are fundamentally against any form of third-party control. That is why some blockchain experts are against the IEO.

#3 Bots can be programmed to participate in IEOs and beat out human investors.

#4 Both the project team and an IEO exchange may keep an unreasonably large portion of tokens to themselves, which may result in manipulating prices later on.

#5 To get funding both the IEO platform and project managers have the incentive to create as much hype as possible. Be sure to check the project’s whitepaper, and idea, before diving into any IEO.

Now you have a complete understanding of what is IEO, its benefits and drawbacks, and how it differs from ICO.

But if you want to become an investor in an IEO project then, you should pick a good platform that conducts Initial Offerings and is backed by a reputed exchange.

To help you with choosing, I listed some IEO platforms created by reputed crypto exchanges.

Top IEO Platforms.

1) Binance Launchpad.

Since 2018 Binance is the biggest cryptocurrency exchange in the world.

They started their IEO platform Binance Launchpad operations in 2017 and became mainstream in 2019.

At the time of writing this post, they completed 15 IEOs in which BitTorrent’s BTT token initial offering is considered the biggest IEO till now.

The entire BitTorrent’s initial offering supply of 59 billion tokens ended up getting sold and even caused the exchange to experience minor technical difficulties.

Remember if you want to join Binance Launchpad, you should have a Binance KYC-verified account.

Join Binance Launchpad.

2) Ku Coin Spotlight.

Ku Coin well-known crypto exchange in the world and a former top 10 exchange that has lost its position due to decreased trading volume.

They launched their IEO platform Spotlight in early 2019 since then they successfully held the 7 initial offerings.

Their first initial offering project MultiVac raised more than 16 million.

Ku Coin Spotlight website.

3) Houbi Prime.

Houbi is the second biggest crypto exchange after Binance.

They launched their IEO platform Houbi Prime in March 2019.

Houbi Prime’s Direct Premium Offering (DPO) feature enables its customers to immediately deposit purchased tokens or coins to their account using Hubi Token(HT) also Houbi allows early access to initial offerings below market price.

Houbi Prime completed the first selective token sale event in a matter of seconds, with token prices surging by 250% immediately afterward.

Sign Up to Houbi to take part in IEOs.

4) OKX Jumpstart.

OKX, the world’s largest crypto exchange by turnover, recently rebranded from OKEx.

Their IEO platform launched in April 2019.

To allow quality Blockchain projects and avoid oversubscription, they follow the “subscription and allotment” method.

Under this method, they only allow a user who holds 500 OKB (OKEx Exchange token) tokens for seven days or at least 3,500 OKB at the snapshot time before the token sale.

Till now, they successfully conducted 15 IEOs, and the average ROI is approx 285%.

Join the OKX Jumpstart platform.

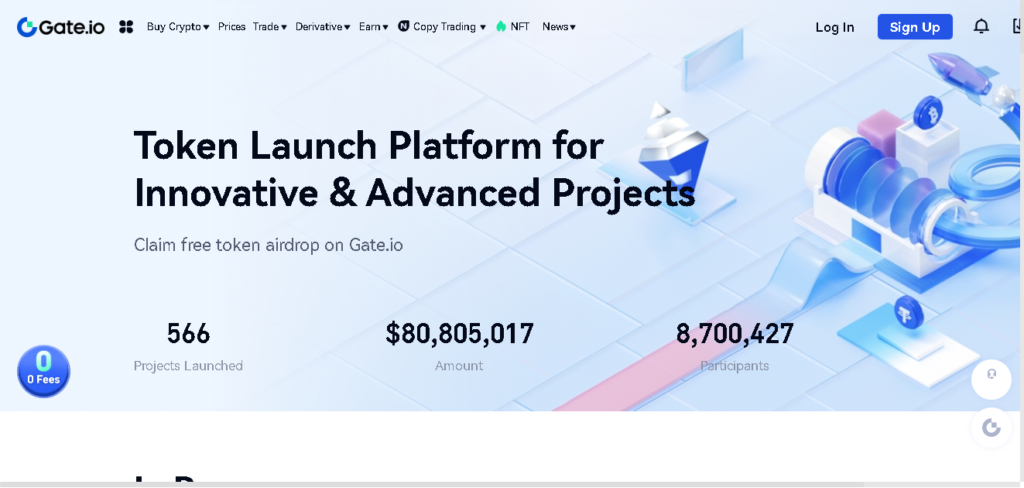

5) Gate.io Startup.

Gate.io is one of the oldest crypto-to-crypto exchanges started in 2013 in China and later rebranded in 2017 as Gate.io.

Exchange offers many trading features and is also security savvy and rated as one of the top exchanges in terms of cybersecurity by CER.

After the rebranding, the exchange launched the Gate.io Startup platform, where crypto projects can raise money with the help of the exchange.

Currently, the platform hosts more than 500 offerings and collected more than $80 million.

The platform makes it easy for you to find out the ongoing, upcoming, and finished offerings with details so you can participate.

Signup for Gate.io.

6)Probit.

Probit is a South Korean exchange operating since 2018.

The exchange offers many trading services like crypt-to-crypto, fiat to crypto, and many other trading options.

Plus, it also hosts many coin offerings on the dedicated IEO section almost every week, meaning that you might have a chance at acquiring the hottest new tokens at its base price.

But the problem with the exchange is that the IEO platform is in the Korean language and currently supports the native fiat currency South Korean Won (KRW).

Use Probit IEO platform.

These are all the 6 best IEO platforms successfully conducting Initial Offerings so far. Now it is your turn to choose the best suitable platform from the list.

Conclusion.

Initial Exchange Offering is by far considered the best way to raise and invest in crypto initial funding.

By including the trusted third party, IEO enables a trustworthy relationship between the project and investor for a long time that will benefit both.